Contents

Bitcoin price today crosses $40,000 milestone for the first time in the current year, riding a surge in momentum. This upswing is largely fueled by widespread optimism surrounding potential U.S. interest rate cuts and the imminent approval of U.S.-stockmarket traded BTC funds.

Key Highlights:

- Bitcoin breaches $40,000 mark, hitting $41,522 on Monday, marking its highest value since April 2022.

- Market sentiment shifts positively as BTC breaks out of 2022’s bearish trend, bolstered by institutional interest and Microstrategy’s $593 million Bitcoin investment.

- Broad market rally driven by expectations of U.S. interest rate cuts; potential approval of spot bitcoin ETF fuels market optimism.

Momentum Shifts as Bitcoin Price Today Hits $41,522

On Monday, the world’s largest cryptocurrency hit an impressive $41,522, marking its highest value since April 2022. This surge seems to dispel the gloom that had enveloped the crypto markets following the collapse of FTX and other crypto-business failures in 2022.

Justin d’Anethan, the head of business development for Asia-Pacific at Keyrock, a digital assets market making firm, noted a significant shift from the bearish sentiment of 2022 and early 2023. He highlighted evidence of institutional buying throughout November, signaling renewed interest.

Microstrategy’s Bitcoin Investment

Bitcoin-investor Microstrategy disclosed its purchase of an additional $593 million in bitcoin during November, underlining the growing confidence and investment in the cryptocurrency.

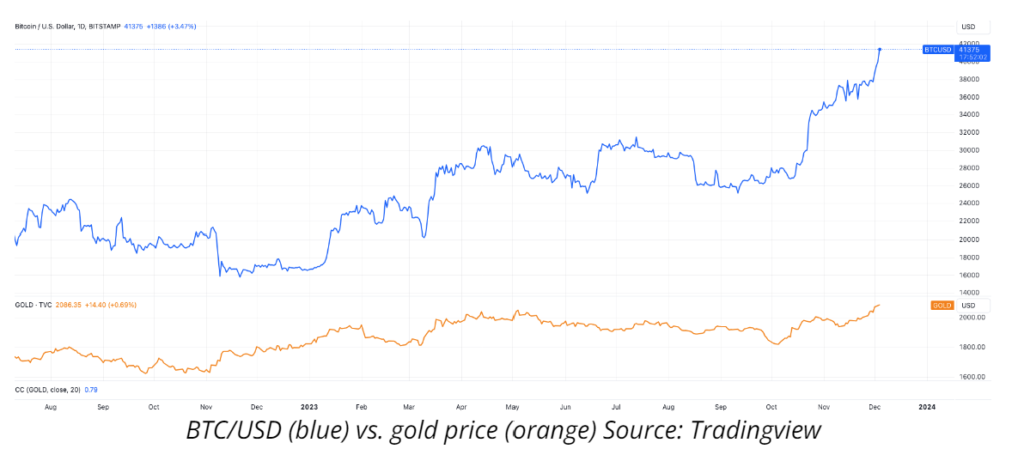

Beyond BTC, riskier investments and interest-rate sensitive assets like gold have witnessed a substantial rally in recent weeks. This surge is driven by speculation that the U.S. Federal Reserve might conclude its rate hikes and potentially initiate cuts in early 2023. Additionally, reports suggesting the imminent approval of a spot bitcoin ETF have fueled market optimism.

Also Read: Bitcoin News Today: Bitcoin Price Surges Near $40k

Gold Breaks All-Time High Record

Bitcoin has skyrocketed by over 140% since the year’s start, hinting at a bullish trend. Matrixport’s research head, Markus Thielen, projects Bitcoin to surpass $60,000 by April 2024 and potentially reach $125,000 by the end of 2024, following historical post-bear market cycles and upcoming halving events.

The anticipation for a spot Bitcoin ETF in the U.S. intensifies with 13 bidders, including industry giants like BlackRock and Grayscale. Analysts at Bloomberg foresee potential approvals for all pending bids by Jan. 10, marking a potential turning point for institutional engagement and BTC market.

Bitcoin analyst Willy Woo remarks on the similarity between the current scenario and the launch of the first commodity ETF, SPDR Gold Trust, indicating a significant shift in the market landscape.

As BTC hits above $41,000 after 19 months, mirroring the surge in gold prices surpassing $2,100, the stage is set for potential milestones in the crypto market.

Ethereum’s Surge Alongside Bitcoin

Ether, the cryptocurrency linked to the Ethereum blockchain network, also saw a significant uptick, reaching a 1-1/2 year high at $2,253 on Monday. However, both bitcoin and ether remain below their 2021 record highs.

Amidst BTC surge past $41,000, market-neutral strategies are garnering attention. These strategies, aimed at generating consistent returns regardless of price trends, are regaining traction. The “basis trade,” a market-neutral strategy capitalizing on futures premium, currently offers an annualized double-digit return.

Bitcoin Price Today Premium and Market Expectations

Front-month and longer-dated futures contracts on Deribit are currently trading at an annualized premium of 8% to 12%, signaling potential returns for traders leveraging these market-neutral strategies.

Crypto experts anticipate a further climb in these returns, especially with the anticipated launch of spot-based exchange-traded funds in the U.S. early next year. These developments could potentially surpass previous cycle highs.

Aslo Read: Polygon Network Sees Surge Amid Internal Strategy Talks – Latest Analysis

Factors Driving Bitcoin Price Today Surge

The surge in Bitcoin’s value, which has risen by 54% since October 1, can be attributed to multiple factors. These include anticipation surrounding the launch of spot-based exchange-traded funds in the U.S., the resolution of Binance’s legal matters, geopolitical tensions, and increased institutional involvement.

This revamped structure aims to align with SEO principles and readability while highlighting the surge and the resurgence of market-neutral strategies amidst the current market dynamics.