Contents

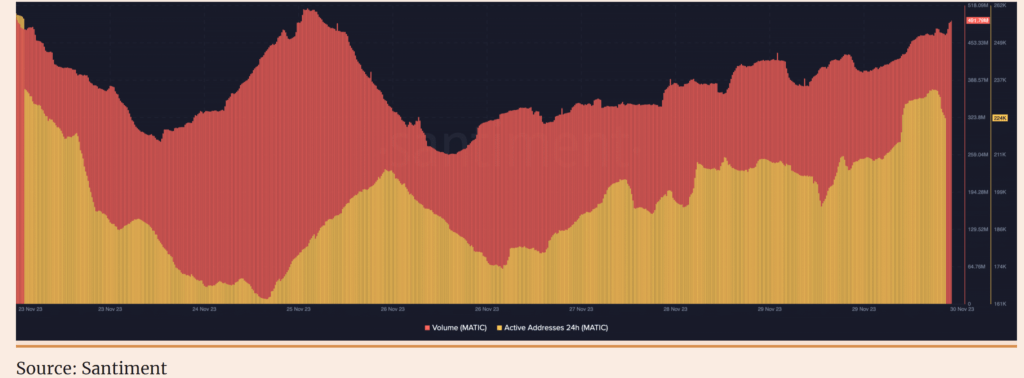

Polygon network has witnessed a surge in volume and active addresses, indicating increased transactions within the network. AMBCrypto’s analysis of Santiment reveals the rise in Polygon’s network activity, with 24-hour active addresses escalating to 224,000 at present.

Key highlights On Polygon Network:

- Cryptocurrency network experiences a significant surge in activity amid internal strategy talks.

- Analysis suggests potential signs of market recovery within the digital currency landscape.

- Discussions around internal strategies and market dynamics are prominent in current cryptocurrency analysis.

- Price predictions and insights offer glimpses into future market scenarios.

- The cryptocurrency landscape showcases adaptability and resilience to market shifts and internal strategies.

Increased Active Addresses: An Indicator of Growing Polygon Network Usage

The surge in active addresses signifies heightened participation of market players engaged in transactions within the Polygon network. Correspondingly, MATIC’s crypto volume has also followed this upward trend, soaring to 491.79 million at the time of writing.

Despite the surge in network activity, concerns have emerged regarding the decoupling between MATIC’s value rise and the actual increase in demand. Joao Wedson’s analysis, as reported by AMBCrypto, suggests a possible internal buying pressure influencing the token’s upward momentum.

Wedson’s observation hinted at a divergence between the inflow and outflow on exchanges, raising doubts about organic demand proportional to the increased reserves held by exchanges.

Bearish Sentiment Looms Despite Momentary Bullish Outlook

MATIC’s Weighted Sentiment surged to 4.14 on November 15th, reflecting bullish market sentiment. However, within a day, it plummeted to -0.306, indicating a swift transition from bullish to bearish perception.

While no confirmation is available, the sustained negative sentiment hints at a potential downturn. Santiment’s data shows a higher exchange outflow (107,000 MATIC tokens) than inflow (75,000 MATIC tokens), implying long-term commitments by market participants in retaining MATIC.

Also Read: Vivek Ramaswamy Unveils Best Crypto Roadmap for 2024

Matic Price Predictions and Market Outlook

The market indicates a possibility of MATIC’s price recovery, potentially targeting $0.80 in the coming days. Long-term projections envision MATIC reaching $1.61 by 2024, based on current trends and analysis.

Polygon (MATIC) operates as a Layer 2 scaling solution for Ethereum-compatible blockchain platforms. Its primary focus lies in empowering developers to create efficient and cost-effective decentralized applications (dApps).

Key Features of Polygon Network:

- Scalability: Employs PoS and Plasma chains to enhance transaction throughput.

- Interoperability: Supports various scaling solutions and chains.

- Security: Offers decentralized security leveraging Ethereum’s mainnet.

- Modularity: Provides a customizable framework for developers.

- Developer Experience: Seamlessly integrates Ethereum’s tooling and environment.

MATIC Token Overview and Price Prediction 2024

MATIC serves as the native utility token of the Polygon network, utilized for transaction fees, staking, and governance purposes. Presently, there are 9,299,803,031 MATIC tokens in circulation out of a total supply of 10,000,000,000 MATIC tokens.

In the short term, MATIC is predicted to fluctuate between $0.75 and $1.20 by December 25, 2023. Long-term projections suggest a potential rise to $1.64 by June 2024.

Also Read: HTX exchange Restoration Within 24 Hours After $30M Hack

Conclusion

Polygon’s recent surge in network activity alongside MATIC’s analysis paints a nuanced picture of market sentiment. While short-term fluctuations occur, long-term prospects hint at potential growth, reflecting the dynamic nature of the crypto landscape. Polygon network has witnessed a surge in volume and active addresses, indicating increased transactions within the network. AMBCrypto’s analysis of Santiment reveals the rise in Polygon’s network activity, with 24-hour active addresses escalating to 224,000 at present.