Contents

Bitcoin’s price is on an upward trajectory, with four significant instances of surging near $40,000, reaching levels unseen since the May 2022 crash of the supposed “stablecoin” TerraUSD. Bitcoin Price Surges Near $40K. Several factors are fueling this surge, with the possibility of Securities and Exchange Commission (SEC) approval for a Bitcoin exchange-traded fund (ETF) standing out. However, the most significant catalyst may be the anticipated Federal Reserve rate cuts, with markets now betting on a commencement by March. This surge highlights the cryptocurrency’s resilience and its potential to redefine market dynamics in the coming months.

TDLR:

- Bitcoin surged nearly $40,000 four times, marking a significant price increase since the May 2022 crash.

- Speculation on SEC approval for a Bitcoin ETF and anticipated Federal Reserve rate cuts are key factors driving Bitcoin’s surge.

- Economic indicators, including the PCE price index and ISM manufacturing survey, along with a softer U.S. dollar, contribute to the bullish sentiment around Bitcoin.

Bitcoin’s Persistent Surge: Reaching Near $40K Four Times:

In the last 24 hours through late Saturday afternoon, Bitcoin’s price increased by 1.8%, reaching approximately $39,552, as reported by CoinDesk. Coinbase Global (COIN), the crypto trading platform operator, experienced a 7.25% rise in Friday’s stock market activity, continuing an upward trend since its breakout on November 24.

SEC Approval and Bitcoin ETF: Catalysts Behind the Surges:

Bitcoin Price Surges Near $40K as Recent Developments Indicate that the SEC has engaged with major players such as Grayscale, BlackRock (BLK), and Nasdaq (NDAQ) regarding their applications for a Bitcoin ETF. If approved, such a fund could open the door to a broader investing audience, allowing investors to wager on Bitcoin’s price without direct cryptocurrency acquisition.

Fed Rate Cuts and Global Impact: Shaping Bitcoin’s Trajectory

The Federal Reserve’s primary inflation gauge, the PCE price index, revealed overall and core inflation at a 2.5% annual rate through October. Economic indicators, including the Institute for Supply Management’s manufacturing survey index, suggest potential challenges ahead, with the manufacturing index remaining below 50 in contractionary territory and the employment subindex sliding to 45.8.

Bitcoin Price Surges Near $40K Again with inflation decreasing rapidly, New York Fed President John Williams stated on Thursday that the current 5.25% to 5.5% federal funds rate is the most restrictive in 25 years. Markets are pricing in the likelihood of five quarter-point rate cuts by the end of 2024, according to CME Group’s FedWatch tool.

The diminishing interest-rate outlook has prompted a reversal in the U.S. dollar’s appreciation against global currencies, falling 3% since the Fed’s November 1 meeting. This shift alleviates inflation and borrowing constraints globally, particularly for emerging market economies.

Bitcoin Price Surges Near $40K for the Fourth Time as Bitcoin’s recent bullish trend appears to align with the Nasdaq, which has surged 39% from its December 28 bear-market closing low. Despite the collapse of TerraUSD in May 2022, wiping out $40 billion in market value, Bitcoin has experienced a revival, rising 47% since mid-October while the Nasdaq climbed about 7%.

Read More: Cristiano Ronaldo hit by SEC unregistered securities at Binance

BTC Liquidations Sustain High Levels as Short Positions Face Investor Losses:

On Sunday, BTC liquidations continued to remain elevated as investors experienced losses on short positions. Coinglass reported that BTC liquidations reached $36.41 million, of which $32.32 million were attributed to short positions. Among the platforms, OKX, Binance, and Huobi witnessed the highest percentages of BTC liquidations. In the past 24 hours, a staggering 54,327 traders faced liquidation, contributing to a total liquidation sum of $143.45 million. Notably, the largest single liquidation order occurred on OKX – BTC-USDT-SWAP, with a substantial value of $1.96 million.

Source:coinglass

Bitcoin’s Technical Analysis:

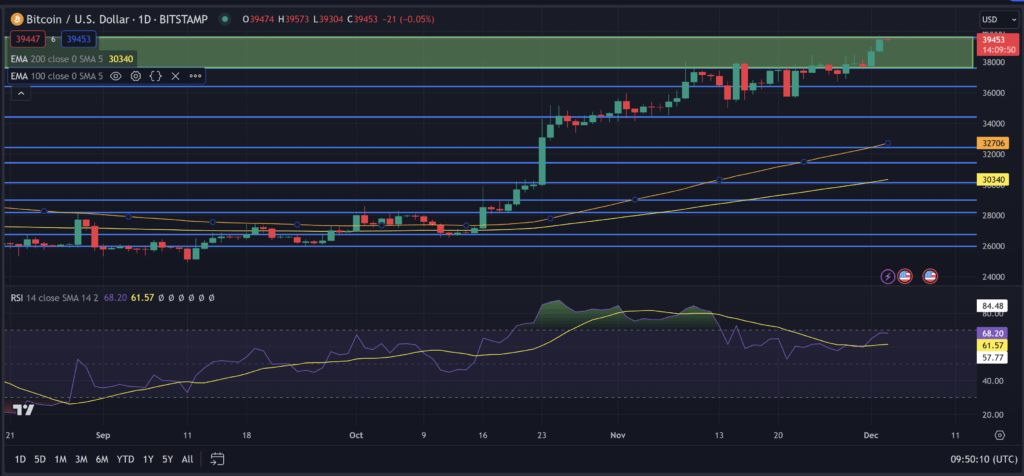

BTC maintained its position above both the 100-day and 200-day EMAs, confirming positive signals for price trends.

Source :Tradingcompass

A breach of the $39,600 resistance level in BTC would pave the way for an attempt at the psychological barrier of $40,000.

For crypto investors, the focus remains on BTC-spot ETF developments and SEC activities.

A decline below the $39,000 mark would bring the $37,600 support level into consideration.

The 14-Daily RSI reading stands at 67.87, signaling a potential BTC breakthrough above the $39,600 resistance level before reaching overbought conditions.

YOU MAY ALSO LIKE:

Zhao Try Fleeing, US Gov Push Strong To keep him Inside

Kraken Exchange Co-Founder Affirms Strong Fairness in Crypto