Contents

The upcoming US Federal Reserve decision holds significant weight in financial markets, particularly in influencing the EUR/USD pair. As the Fed is widely expected to maintain its policy rate at 5.25%-5.50% for the fifth consecutive meeting, investors are closely eyeing various indicators within the monetary policy statement and the subsequent remarks from Fed Chair Jerome Powell.

US Federal Reserve Decision: Fed Policy Outlook and Market Reactions

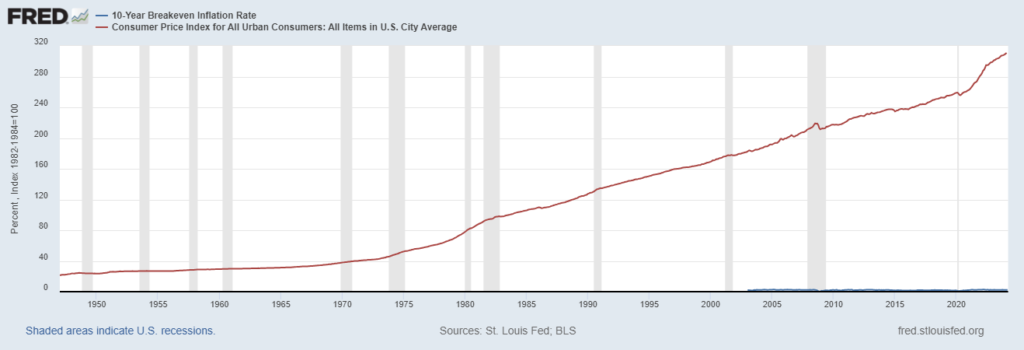

In addition to interest rate projections, the Federal Reserve’s decision is influenced by inflation rates and expectations. The central bank closely monitors both consumer and producer inflation figures to gauge the economy’s health and make informed policy decisions. Recent macroeconomic data releases have shown a gradual uptick in consumer and producer inflation in the first few months of the year. This upward trend in inflation, coupled with a relatively healthy labor market and optimistic activity-related data, such as forward-looking PMI surveys, suggests that the US economy is likely to avoid a recession. Against this backdrop, the Fed’s inflation forecast becomes crucial. The publication in December pointed to Fed officials projecting inflation averaging 2.4% in 2024, before reverting to the 2% target by 2026. Any revisions or updates to these inflation forecasts within the Summary of Economic Projections could significantly impact market sentiment and influence the trajectory of the USD against other currencies, including the EUR. Traders will carefully analyze the Fed’s stance on inflation during Chairman Powell’s press conference, as it will provide vital insights into the central bank’s future monetary policy decisions.

Source: fred.stlouisfed.org

Powell’s Press Conference and Market Reflection

Market participants will scrutinize the Summary of Economic Projections (SEP) and the dot plot, looking for cues on future interest rate trajectories. A reaffirmation of officials’ preference for 75 basis points rate cuts in 2024 may signal a potential policy pivot in June, potentially impacting US Treasury bond yields and the USD’s strength. Conversely, a more hawkish stance from the Fed, projecting a 50 basis points reduction citing robust economic indicators, could bolster the USD.

US Federal Reserve Decision: EUR/USD Technical Outlook

Technical analysis for the EUR/USD pair suggests a critical juncture, with the pair hovering near key moving averages on the daily chart. The Relative Strength Index (RSI) indicates buyer hesitancy. Resistance and support levels provide crucial insights for traders, with key levels including 1.0870-1.0840, 1.0785, 1.0700, 1.0950, 1.1000, and 1.1100.

Conclusion

The impending Fed decision is expected to trigger heightened volatility in the USD. Traders may opt to wait until the initial market excitement subsides before determining the currency’s direction. Monitoring bond and stock futures markets in the following days can offer valuable clues regarding market perceptions of the Fed’s announcements. As always, traders should remain adaptable and responsive to evolving market conditions.