Contents

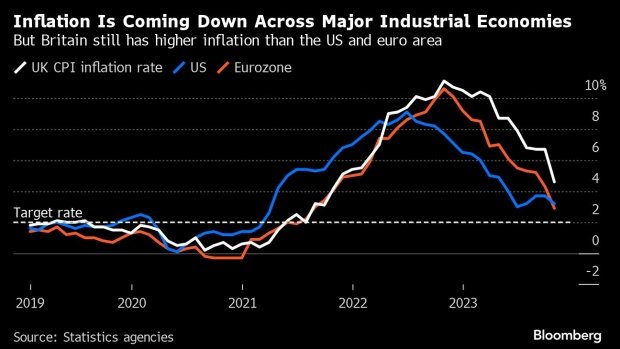

Economists anticipate the Bank of England (BOE) will keep interest rates steady in this week’s decision, aiming to discourage expectations of a rate cut by mid-2024. The central bank remains cautious about inflation, expressing concerns over the potential for rising prices. In light of UK inflation concerns, the BOE signals a commitment to maintaining elevated borrowing costs until at least 2024, emphasizing its dedication to curbing inflationary pressures within the economy.

Highlights:

- Bank of England expected to maintain current interest rates.Caution expressed about inflation, commitment to elevated borrowing costs until 2024.

- Concerns rise as money markets bet on an 80 basis points easing in 2024, softening financial conditions.

- Projected 0.1% GDP contraction raises concerns about a prolonged downturn.

- Governor Bailey emphasizes persistent inflation, targeting a 2% return by end of 2025.

- BOE faces challenges as market expectations impact financial conditions; potential pushback speculated in December meeting minutes.

source: Statistics agencies

read more: Bank of England Inflation May Raised Above 2%, Two Banks Warn

UK Inflation Concerns and Monetary Policy

Governor Andrew Bailey and the Monetary Policy Committee emphasize persistent worries about inflation, supporting their stance on keeping rates at their highest level in 15 years. Financial analysts predict no rate change this week, but the UK inflation concerns arise as money markets increasingly bet on an 80 basis points easing in 2024, up from 50 six weeks ago.

Market Reactions and Hawkish Stance

Growing bets on rate cuts are seen as softening financial conditions, diminishing the impact of the BOE’s recent tightening measures. Analysts anticipate a potential hawkish response from the BOE to counter these expectations and maintain a higher for longer strategy until it becomes untenable.

Global Economic Shift

Rapid rate hikes globally have led to a dual effect on inflation and economic growth. Traders anticipate central banks, including the BOE, to shift focus from fighting receding inflation to supporting economies at risk of recession.

UK Economic Outlook

Figures expected this week may reveal a 0.1% contraction in the UK’s GDP for October, sparking concerns about a prolonged downturn. Investors adjust policy expectations, with a chance of a quarter-point cut by May and a near certainty of such a move by June.

BOE’s Inflation Caution

BOE Governor Bailey emphasizes that markets are underestimating the persistence of inflation, expecting a return to the 2% target only by the end of 2025. Analysts suggest the BOE will likely reiterate a commitment to high rates for an extended period.

Market Expectations and Potential Pushback

The BOE faces challenges as market expectations of rate cuts impact financial conditions, undermining the impact of recent rate hikes. There’s speculation that the BOE may explicitly push back against market expectations in its December meeting minutes, similar to a warning issued in November 2022.

source: Statistics agencies

Conclusion

The BOE is expected to maintain a cautious stance, emphasizing the need for restrictive rates amid inflation concerns. Analysts anticipate potential pushback against market expectations to reinforce the message of a prolonged period of high borrowing costs.

also read: UK GDP Monthly Estimate for September 2023: 0.2% Growth