Contents

- 1 Weekly Prediction for GBP/USD: UK GDP Stable in Q3 2023

- 2 Challenges Persist in UK Economy Amid Stagnation: Key Events for the Pound This Week

- 3 US Treasury Volatility Affects Dollar: Focus on October CPI for Fed Rate Hike Clues

- 4 Weekly Prediction for GBP/USD: PPI and Retail Sales Data on Wednesday, Jobless Claims on Thursday

- 5 GBP/USD Weekly Recap: Uptick Followed by Decline, Monitoring Rebound Potential

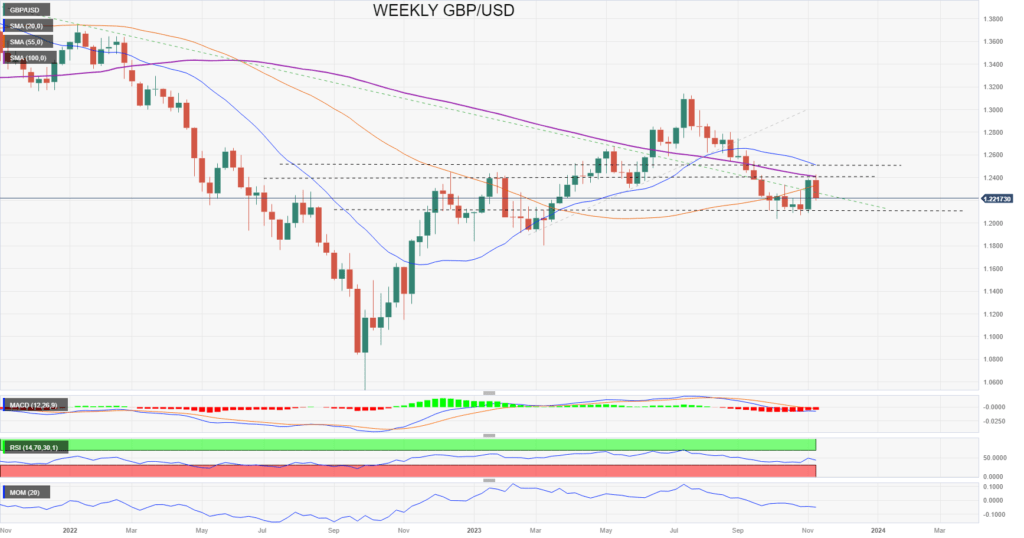

Throughout the week, the GBP/USD pair experienced a gradual decline, primarily propelled by a stronger US Dollar. This downward trajectory accentuated by lackluster economic data in the UK and dovish remarks from Bank of England (BoE) policymakers. The pair retreated from its one-month highs above 1.2400, settling around the 1.2200 level. Given the prevailing fundamental factors favoring the Dollar, any potential upward movement in the pair is susceptible to notable corrections.

Looking ahead to the upcoming week, significant economic data set to be released. Including the Consumer Price Index (CPI) for October in both the United States and the United Kingdom. The inflation data assumes importance as it can substantially impact monetary policy expectations from both the Federal Reserve (Fed) and the Bank of England.

Weekly Prediction for GBP/USD: UK GDP Stable in Q3 2023

On Friday, the United Kingdom’s Office for National Statistics (ONS) reported that Gross Domestic Product (GDP) remained steady in the three months leading up to the end of September. Defying expectations of a 0.1% contraction. However, this marks the weakest quarter since Q3 2022. The positive note came from the monthly reading, revealing a 0.2% expansion in September, exceeding expectations of a 0.1% contraction. Despite surpassing expectations, the economy is displaying signs of stagnation, heightening concerns about the potential onset of a recession. Huw Pill, Chief Economist of the Bank of England (BoE), surprised the market during the week by suggesting that expectations of interest rate cuts by mid-2024 were not entirely unwarranted. Impacting the Pound negatively.

In contrast, Federal Reserve Chairman Jerome Powell provided support to the US Dollar by discussing “head fakes” in inflation and expressing the FOMC’s lack of confidence in achieving a sufficiently restrictive monetary policy stance. These statements contributed to the Dollar’s rebound following last week’s decline.

Despite growing at an annualized rate of nearly 5% in the third quarter, some models now indicate that the US economy is expanding at around 2%. This suggests that the US economy remains resilient, surpassing the performance of both the UK and the Eurozone. In a relatively subdued week for economic data, Continuing Jobless Claims rose for the seventh consecutive week. Reaching the highest level since mid-April, offering evidence of a softening labor market.

Challenges Persist in UK Economy Amid Stagnation: Key Events for the Pound This Week

The UK economy faces mounting challenges amidst its current state of stagnation. Tuesday will see the release of labor market data. With analysts closely examining Average Earnings and shifts in employment, seeking positive indicators for the Pound.

A crucial report for the Pound slated for Wednesday. Which featuring the release of the Consumer Price Index (CPI) for October. Projections suggest a continued easing of inflation, albeit remaining above the target. The Consumer Price Index (CPI) is anticipated to show a monthly rise of 0.2%. While the annual rate of Core CPI is projected to decline from 6.1% to 5.8%. While a slowdown in inflation could exert downward pressure on the Pound. It would be viewed favorably by the Bank of England and the wider economy, potentially offsetting negative momentum for the currency. The key factors shaping the monetary policy stance continue to be inflation and employment.

More pertinent UK data is anticipated on Friday with the unveiling of Retail Sales.Prominent speakers this week include Bank of England policymaker Catherine Mann on Monday, followed by Randall Kroszner and Dave Ramsden on Thursday. Although reports suggest a potential UK cabinet reshuffle next week, it is unlikely to involve changes to the economic team.

Also Read: US Dollar Fate Tied to US Inflation, Overview on Currencies

US Treasury Volatility Affects Dollar: Focus on October CPI for Fed Rate Hike Clues

The Treasury market has witnessed volatile movements, impacting the US Dollar. Despite initial expectations of declining US yields, the bond rally seems to have concluded following a weak 30-year auction on Thursday and comments from Fed Powell. A resurgence in yields, reaching new highs, could place downward pressure on Wall Street, boost the US Dollar, and trigger concerns among investors.

On the upcoming Tuesday, the United States is set to unveil the October Consumer Price Index (CPI) report. Holding significant importance in the current economic climate. With the US economy displaying resilience, an upturn in inflation could lead to serious consideration of another rate hike by the Fed. Conversely, a notable slowdown, particularly in the Core rate expected to remain at 4.1% YoY, would align with the prevailing market narrative that the Fed has completed its rate hikes.

Weekly Prediction for GBP/USD: PPI and Retail Sales Data on Wednesday, Jobless Claims on Thursday

Wednesday brings additional inflation data with the release of the Producer Price Index (PPI). Additionally, the Retail Sales report is due that day. Given the substantial contribution of personal consumption to Q3 GDP growth, these figures hold significance ahead of the holiday season. An anticipated 0.1% decline follows a notable 0.7% surge in September.

Thursday’s closely watched weekly Jobless Claims report discloses an upward trend in Continuing Claims, reaching the highest level since mid-April in the week ending October 28.

The combined effect of central banks pausing their rate hike cycle, adopting a “data-dependent” stance, and the imminent release of inflation figures from the UK and the US next week could wield a substantial influence on the currency pair. Geopolitical and political considerations will also play a role in shaping market dynamics.

GBP/USD Weekly Recap: Uptick Followed by Decline, Monitoring Rebound Potential

Following an uptick in the preceding week, the GBP/USD pair experienced a gradual descent, settling precariously above the 1.2200 level and the 20-day Simple Moving Average (SMA). Despite a five-day downturn, the potential for a rebound exists. However, it is vital for the price to maintain its position above 1.2200. As a dip below this threshold could swiftly propel the pair toward 1.2100.

On the weekly chart, the GBP/USD faced resistance at the 100-week SMA, prompting a retracement. The price continues to remain below the 20-week SMA, indicating a prevailing downward bias. The price persists below the 20-week SMA, signaling a prevailing downward inclination. This outlook would only change in the unlikely event of a weekly closure surpassing 1.2510. Conversely, a conclusion below 1.2100 would indicate the potential for further losses in the future.

Source: FX Street

Do you need help in finding the best crypto exchange for your needs?

Click here: The Best Crypto Exchange Finder