Contents

- 1 Powell’s FOMC Outlook and Its Implications on Monetary Policy and the US Dollar

- 2 EUR/USD Technical Analysis: Support and Resistance Dynamics in Focus

- 3 Us Dollar Technical Analysis : USD/JPY Potential Impacts of Tokyo’s Intervention

- 4 AUD/USD Analysis: Support Challenges and Potential Bullish Reversal Scenarios

The US dollar, as assessed by the DXY index, experienced a rebound in the past week. Following a relatively subdued performance early in the month. The increase in Treasury yields, triggered by a disappointing U.S. Treasury bond auction and assertive comments from Fed Chair Powell. Contributed to the dollar’s advancement, concluding the week just below the 106.00 level.

Looking ahead to the upcoming week, attention will be on the October consumer price index (CPI) report. Given the Federal Reserve’s heightened sensitivity to incoming data and its vigilance regarding potential upward inflation risks, the significance of the latest CPI figures is amplified. That carrying added weight in financial markets. Against this backdrop, there is a potential for increased volatility in the forthcoming trading sessions.

In terms of forecasts, it is expected that the headline CPI rose by 0.1% on a seasonally adjusted basis last month. Resulting in a decrease in the annual rate from 3.7% to 3.3%. Simultaneously, the core indicator, excluding food and energy, is anticipated to increase by 0.3% on a monthly basis. Leading to a year-over-year reading of 4.3%, aligning with the outcome observed in September.

Powell’s FOMC Outlook and Its Implications on Monetary Policy and the US Dollar

In his most recent public appearance, the head of the Federal Open Market Committee (FOMC) stated that policymakers are not certain they have implemented a sufficiently restrictive stance to achieve price stability. Powell also emphasized the uncertainty surrounding the potential advancement in controlling inflation and acknowledged that achieving stronger economic growth might necessitate an increase in borrowing costs.

Collectively, Powell’s statements suggest that the central bank will employ a data-centric approach in its future decision-making processes. This opens the door to the possibility of further policy tightening later this year or in early 2024 if economic conditions do not unfold favorably. For instance, an unexpected increase in inflation data next week could sway policymakers toward contemplating rate hikes at upcoming meetings.

In a broader context, outcomes in the Consumer Price Index (CPI) that prompt a more hawkish reassessment of interest rate expectations should positively impact the US dollar. Conversely, a weak CPI report that diminishes the likelihood of additional tightening by the FOMC could halt the recent U.S. dollar rally by putting downward pressure on US Treasury yields.

Also Read: Stock Market Recap: Dow Closes Down Following Powell Speech

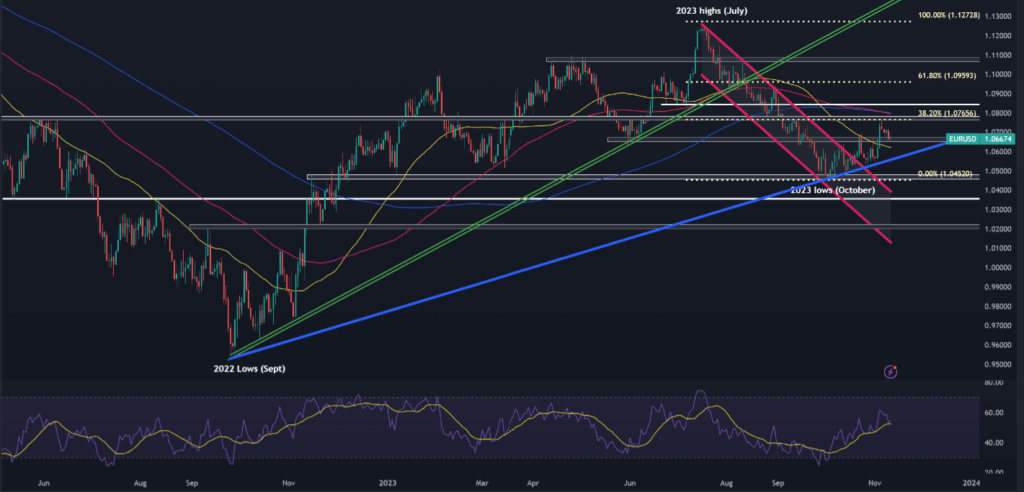

EUR/USD Technical Analysis: Support and Resistance Dynamics in Focus

Following resistance encountered at the 1.0765 Fibonacci level. The US Dollar and EUR (EUR/USD) pair has retreated, currently stabilizing just above the lower limit of a support range near 1.0650. It is imperative for the bulls to safeguard this support; failure to do so may lead to a descent towards trendline support at 1.0555. Persistent weakness increases the likelihood of revisiting the lows recorded in 2023.

Conversely, an improvement in market sentiment and a resurgence of bullish control would bring attention to the initial technical barrier at 1.0765. This level is significant as it marks the convergence of the 200-day simple moving average with the 38.2% Fibonacci retracement of the decline witnessed from July to October. Successfully overcoming this resistance could fortify the upward momentum, opening the path for an advance towards 1.0840.

Us Dollar Technical Analysis : USD/JPY Potential Impacts of Tokyo’s Intervention

After experiencing a decline earlier in the month, the USD/JPY pair has since recovered its upward momentum in the current week. Breaking through a significant barrier at 150.90 and inching closer to its highest point between 2022 and 2023. That just below the psychological level of 152.00. As the pair advances and nears this critical threshold, traders should proceed with caution. Considering the potential for Tokyo to intervene at any time to suppress speculative activity and strengthen the yen.

In the event of foreign exchange intervention by Japanese authorities, there is a possibility for USD/JPY to swiftly drop below 150.90 and move towards 149.00. If weakness persists, attention would then shift to 147.25. Conversely, should Tokyo choose to stay on the sidelines and allow the exchange rate to surpass 152.00.

The prospect of an upward surge towards the upper limit of a medium-term ascending channel at 153.40 emerges as a plausible scenario.

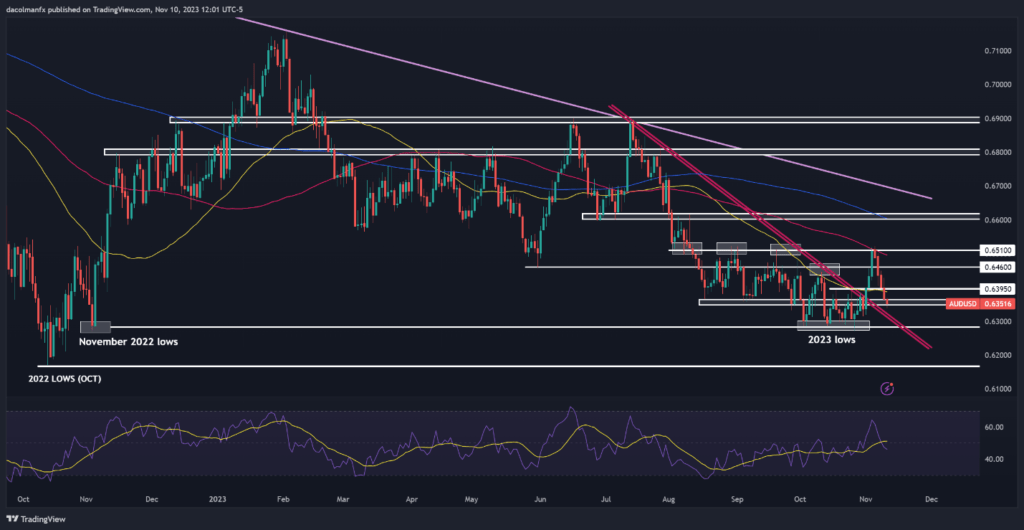

AUD/USD Analysis: Support Challenges and Potential Bullish Reversal Scenarios

AUD/USD faced its fifth consecutive day of decline on Friday. Eradicating all gains from the deceptive breakout observed in the preceding week. Following this retracement, the pair has reached a crucial support zone around 0.6350. It is essential to uphold this support; failure to do so may result in a descent towards 0.6325. If the downward momentum persists, there is the potential for revisiting the lows recorded earlier this year.

Despite the recent setback for the Australian dollar, it might be premature to entirely dismiss the bullish narrative. With this consideration in mind, if the bulls mount a recovery and initiate a bullish reversal from the technical support. Resistance overhead is positioned at 0.6400, followed by a subsequent barrier at 0.6460. Clearing both of these levels to the upside could revive upward momentum, paving the way for a rally toward the November highs near the 0.6500 handle.

Do you need help in finding the best crypto exchange for your needs?

Click here: The Best Crypto Exchange Finder