Contents

- 1 Eurozone Data Disappoints, Eased by Corporate Earnings and Fed Sentiment

- 2 DAX Index and Market Boost: US Retail Sales and Producer Prices Drive Wednesday’s Gains

- 3 DAX Index: Infineon and Siemens Surge, Auto Stocks Lead Gains

- 4 Thursday Spotlight: Lagarde’s Insights and ECB Guidance

- 5 Thursday’s Focus: US Labor Market, Manufacturing, and Fed Insights

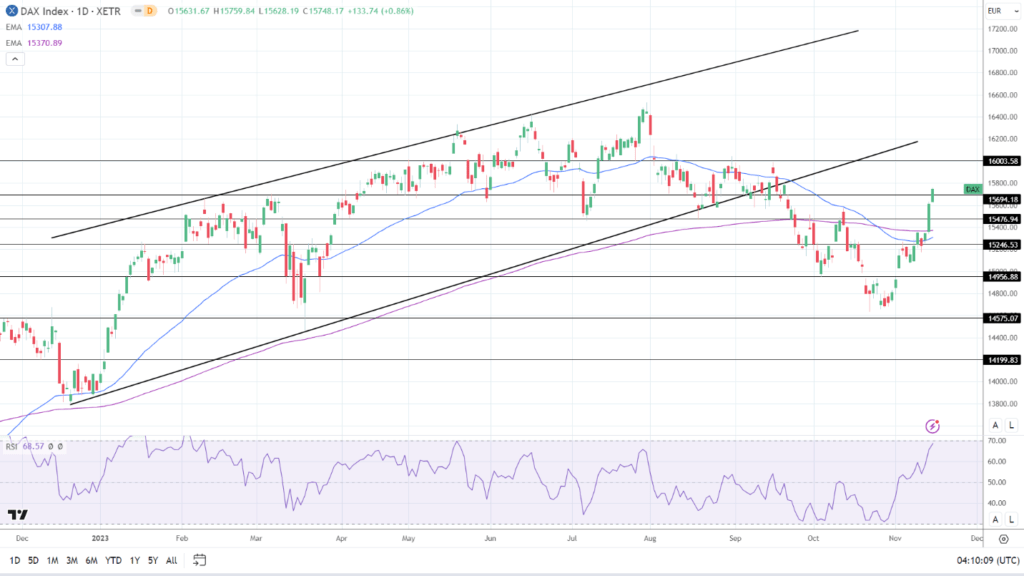

On Wednesday, the DAX index exhibited a positive performance, with a gain of 0.86%. This followed a significant 1.76% rally on the preceding Tuesday, resulting in the DAX closing at 15,748.

Maintaining its position above both the 50-day and 200-day Exponential Moving Averages (EMAs), the DAX Index affirmed bullish pricing signals. A potential upward shift in the DAX Index, surpassing the 15,800 mark, would empower bullish momentum to target the resistance level at 16,004.

The forthcoming focal points for market attention encompass central bank commentary and US economic indicators. Notably, a shift in the Federal Reserve’s stance towards a more hawkish tone, coupled with robust US economic statistics, could exert pressure on the DAX.Conversely, breaching the support level at 15,694 would bring into consideration the support levels at 15,500 and 15,477.

The 14-day Relative Strength Index (RSI) reading stands at 68.57, suggesting that the DAX may approach the 15,800 level before potentially entering an overbought condition.

Eurozone Data Disappoints, Eased by Corporate Earnings and Fed Sentiment

Wednesday saw Eurozone industrial production and trade data fall short of market predictions. Industrial production saw a decrease of 1.1%, while the trade surplus widened from €6.7 billion to €10.0 billion. Economists had expected a 1.0% decline in production and a trade surplus of €22.3 billion.

The impact of these less-than-expected figures mitigated by corporate earnings and sentiment regarding the Federal Reserve.

DAX Index and Market Boost: US Retail Sales and Producer Prices Drive Wednesday’s Gains

Later in the trading session, buyer interest bolstered by encouraging trends in US retail sales and producer prices. Exceeding expectations, the robust US retail sales figures alleviated concerns about a significant economic downturn. Furthermore, shifts in producer prices sparked speculation about the Federal Reserve potentially concluding its cycle of interest rate hikes.

Also Read: US Consumer Inflation Unexpected Softening of in October

During Wednesday’s trading, the Nasdaq Composite Index and S&P 500 registered gains of 0.07% and 0.16%, respectively, while the Dow saw a notable increase of 0.47%.

DAX Index: Infineon and Siemens Surge, Auto Stocks Lead Gains

Infineon Technologies saw a notable surge of 9.43% as investors responded positively to earnings that exceeded expectations and an optimistic outlook for 2024. Siemens Energy AG also experienced a substantial 8.88% jump following the announcement of securing a credit line and obtaining guarantees from the German government.

Auto stocks were among the top performers as well. Daimler Truck Holding led with a rally of 2.87%, followed closely by BMW (+2.06%), Porsche (+2.23%), and Volkswagen (+2.04%). Mercedes Benz Group ended the day with a gain of 1.31%.

Thursday Spotlight: Lagarde’s Insights and ECB Guidance

Thursday will shine a spotlight on ECB President Christine Lagarde, with a particular focus on her comments concerning the economic outlook and interest rates in light of recent economic indicators. If the forward guidance on the ECB rate path takes a less hawkish stance, it could provide support for buyer demand. Additionally, ECB Executive Board members Andrea Enria and Luis de Guindos are scheduled to address audiences.

Thursday’s Focus: US Labor Market, Manufacturing, and Fed Insights

Later in Thursday’s trading session, the spotlight will turn to the US labor market and manufacturing sector. A positive trend in initial jobless claims would strengthen the belief in the Fed concluding its rate hike cycle. Economists are anticipating an uptick in initial jobless claims from 217k to 220k for the week ending November 11.

However, investors should carefully consider the implications of the Philly Fed Manufacturing Index and industrial production figures. Early signs of weaknesses in the US economy could challenge prevailing expectations of a smooth landing.

Looking beyond the data, statements from Fed speakers are poised to play a pivotal role in Thursday’s session. Scheduled addresses from Fed Vice Chair John Williams and FOMC members Michael Barr, Lisa Cook, Loretta Mester, and Christopher Waller are on the docket.

The market’s response to recent inflation and retail sales figures also warrants attention. Support for additional rate hikes could have an impact on buyer demand for DAX-listed stocks.

According to futures markets, a negative start is predicted for Thursday’s session, with the DAX Index and Nasdaq mini indicating declines of 39 and 45 points, respectively.