Contents

The crypto market is poised for significant fluctuations as $2.1 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire today. This substantial BTC and ETH options expiry coincides with the release of the US core consumer price index (CPI) data, adding another layer of complexity to market dynamics.

Discover how the $2.1 billion BTC and ETH options expiry, coinciding with US CPI data, impacts crypto market volatility. Analyze market trends and strategies.

— tradingcompass.io (@TradingcompassI) May 17, 2024

to read more check the link in biohttps://t.co/jfJvqMrNI4

The Significance of BTC and ETH Options Expiry

Options contracts, both for BTC and ETH, represent a financial agreement that gives traders the right, but not the obligation, to buy or sell these digital assets at a predetermined price before a specific date. The expiration of these contracts often leads to increased market volatility as traders rush to close their positions, leading to sharp price movements.

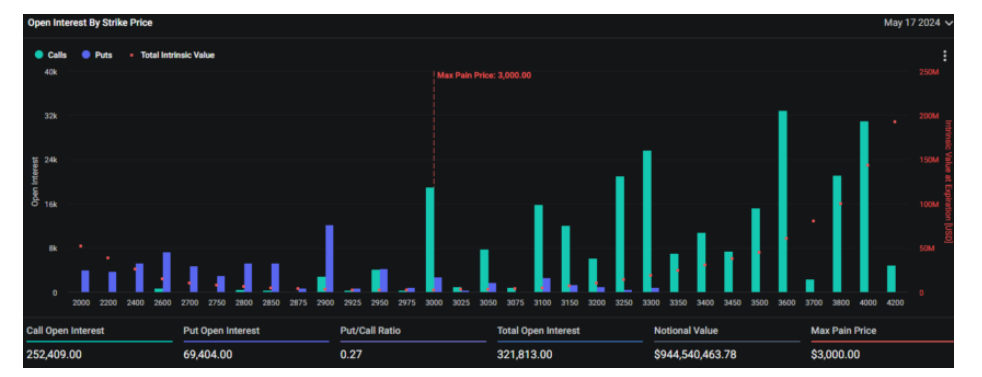

Today, approximately 18,183 Bitcoin options contracts, valued at around $1.18 billion, will expire. This tranche is quite similar to the 18,359 contracts that were settled last week. On the Ethereum side, 321,925 options contracts with a notional value of over $940 million are set to expire. The sheer volume of these expiries underscores the potential for significant market shifts.

Analyzing the Impact of US CPI on BTC and ETH Options Expiry

The recent release of the US core CPI data, which measures the changes in the prices of goods and services excluding food and energy, plays a crucial role in shaping market expectations and trader behavior. The April CPI figure indicated that US inflation grew at a slower pace than anticipated. This news has historically had a positive effect on the crypto market, as evidenced by the recent uptick in Bitcoin’s price from $62,000 to $66,000 following the data release.

The connection between macroeconomic indicators like the CPI and the crypto market is becoming increasingly pronounced. As inflation rates influence traditional financial markets, the ripple effects are felt in the crypto sphere, particularly during periods of significant events such as the BTC and ETH options expiry.

Market Sentiment and Technical Indicators

Deribit data reveals that Bitcoin’s put-to-call ratio stands at 0.62, suggesting a higher prevalence of call options (purchase options) over put options (sales options). This ratio indicates bullish sentiment among traders who expect Bitcoin’s price to rise. The maximum pain point for Bitcoin, identified at $63,000, is the price level at which the highest number of options holders would incur losses. For Ethereum, the put-to-call ratio is even more skewed at 0.27, with the maximum pain point at $3,000.

These metrics are critical for traders and investors to consider, as they provide insights into market sentiment and potential price movements. The maximum pain point often acts as a magnet for prices as the expiry date approaches, influencing traders’ strategies.

Volatility and Market Reactions

According to Greeks.live, a tools provider for crypto options traders, the recent US inflation data has led to a significant reaction in the options market. Implied volatilities (IVs) for major terms spiked to new monthly highs, making options more attractive for buyers. The previously flat market conditions had driven IVs to their lowest points earlier in the year, but recent events have reversed this trend.

The immediate aftermath of the US CPI release saw notable price increases not only in Bitcoin but also in major altcoins like Ethereum and Solana (SOL). This suggests that positive macroeconomic news can serve as a catalyst for broader market rallies, particularly around critical junctures like the BTC and ETH options expiry.

Strategic Considerations for Traders

While the expiration of a large volume of options contracts can lead to sharp price movements, these impacts are often short-lived. The market typically stabilizes within a day, offsetting initial fluctuations. However, the current context, influenced by the US CPI data, could extend the period of heightened volatility.

Traders should closely monitor technical indicators and market sentiment leading up to and following the BTC and ETH options expiry. Understanding the interplay between macroeconomic data and market reactions can provide valuable insights for making informed trading decisions.

Conclusion

The BTC and ETH options expiry, amounting to $2.1 billion, is a significant event in the crypto market, especially as it aligns with the release of critical US CPI data. The interplay between these factors contributes to market volatility and offers both risks and opportunities for traders. By analyzing market sentiment, technical indicators, and macroeconomic influences, traders can better navigate this volatile landscape and make strategic decisions to optimize their positions. As the crypto market continues to mature, such events will remain pivotal in shaping its trajectory.