Contents

Crypto FOMO Index increased as Bitcoin has reached a significant milestone, crossing the $40,000 mark for the first time in 19 months. This surge witnessed in the early Asian trading hours on Monday, has sent ripples across the cryptocurrency market. The surge in Bitcoin’s value, currently hovering near $49,000 apiece, signifies a 3.8 percent gain within the past 24 hours.

Bitcoin’s Milestone Cross – $40,000 Mark

The surge isn’t exclusive to Bitcoin alone. Other cryptocurrencies, including Ethereum, the second-largest crypto by market capitalization, have experienced price hikes. Ethereum, trading beyond $2,200 per unit, has surged by over 8.3 percent in the last seven days, mirroring Bitcoin’s upward trend.

Also Read: HTX exchange Restoration Within 24 Hours After $30M Hack

Crypto FOMO Index Impact on Traders

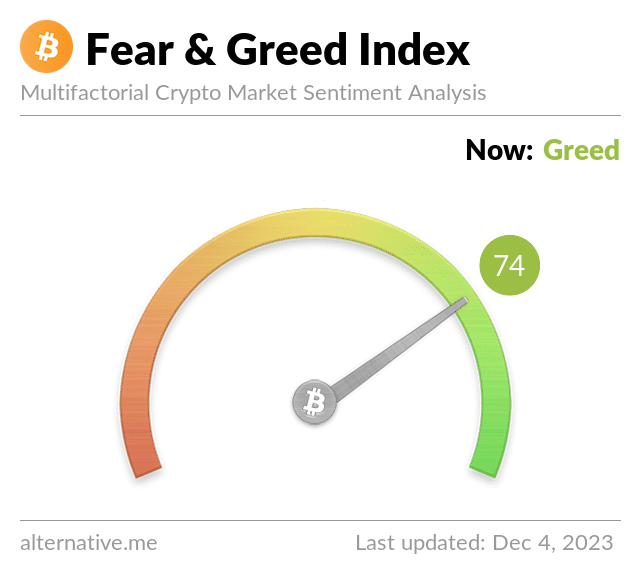

Traders are caught in the grip of FOMO (fear of missing out), driving the latest rally. The crypto fear and greed index have soared to 74, marking the highest level since November 2021. This surge in sentiment is fueled by the anticipation surrounding the Securities and Exchange Commission’s forthcoming decision on the Bitcoin exchange-traded fund. Moreover, the involvement of major traditional finance players like Blackrock has further buoyed optimism in the market.

Turmoil at Binance and Market Dynamics

Despite regulatory actions against Binance in the US, enthusiasm for cryptocurrencies remains unabated. Changpeng Zhao, the former CEO, handed over control to Richard Teng amid legal battles. Binance settled with US federal prosecutors, paying hefty fines, leading to a significant outflow of cryptocurrencies from the exchange.

Also Read: Binance Settlement with the U.S. Government Timeline Actions

Crypto FOMO Index Explained

The Crypto Fear and Greed Index serves as a gauge of market sentiment, ranging from extreme fear to extreme greed, aiding traders in decision-making. It amalgamates social signals and market trends, providing insight into emotional trading behaviors.

U

Market volatility, momentum, social media interactions, dominance, and trends influence the index. Historical data shows how major market events correlate with shifts in sentiment, offering a valuable tool for traders navigating the crypto landscape.

The index primarily responds to short-term market changes rather than signifying longer-term trends, making it popular among traders seeking immediate market insights.

Strategies for Emotional Investment Control

Investors can manage emotions by considering strategies like being cautious in greedy markets, practicing dollar-cost averaging, and diversifying their investment portfolios, recommended by financial experts to mitigate emotional responses during market volatility.

Inspired by CNNMoney’s Fear and Greed Index for stocks, the crypto index mirrors a similar sentiment gauge for the digital currency market.

Accessing the Crypto FOMO Index

Traders frequently refer to this index for quick market insights. Daily updates and various platforms make it accessible, aiding traders in making informed decisions.

The surge past $40,000 signals an intriguing phase in the cryptocurrency realm, highlighting the influence of FOMO on market dynamics and the significance of sentiment-driven indices in aiding trading decisions.