Contents

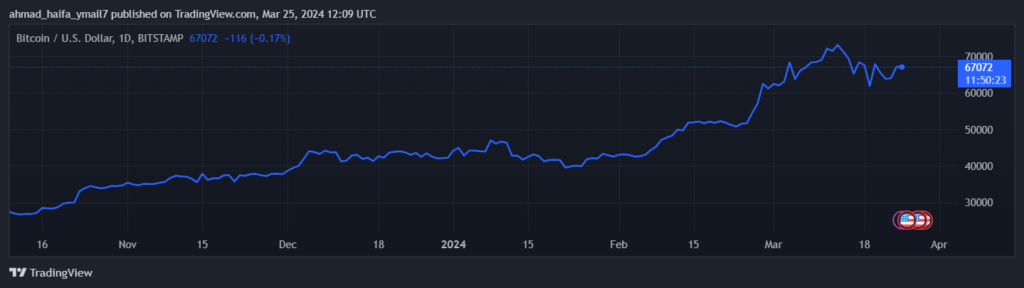

The recent performance of Bitcoin (BTC) has been closely intertwined with developments in the Spot ETF market. This market, which allows investors to gain exposure to Bitcoin through exchange-traded funds that directly hold the underlying asset, has seen significant inflows in recent months. However, recent trends suggest a potential shift in sentiment, raising questions about the future direction of both the Spot ETF market and the Bitcoin price.

Key Points:

- Bitcoin (BTC) rallied 4.88% on Sunday (March 24), ending the session at $67,224.

- Investors likely responded to the downward trend in Grayscale Bitcoin Trust (GBTC) outflows.

- BTC-spot ETF market flow data for March 25 will warrant investor attention late in the Monday session.

Spot ETF Market Flow: A Tale of Two Weeks

The week ending March 22nd painted a concerning picture for the Spot ETF market. Five consecutive days of net outflows, culminating in a total of $2 billion for Grayscale Bitcoin Trust (GBTC) alone, fueled speculation about a drying up of investor interest. These outflows were attributed, in part, to a bankruptcy court ruling allowing the liquidation of GBTC shares by Genesis Global Holdco LLC.

However, a closer look reveals a more nuanced story. President of ETF Store, Nate Garaci, pointed out that Spot Bitcoin ETFs have attracted a net $11 billion and boast Assets Under Management (AUM) of $50 billion in just over two months. He argues that many investment platforms haven’t even begun offering these products, suggesting there’s room for further growth despite the recent outflows.

Further adding to the complexity is the performance of iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC), which have seen a combined 51 consecutive days of net inflows as of Friday. This divergence in inflows between GBTC and these newer entrants highlights the evolving landscape of the Spot ETF market.

The Fear and Greed Index: Balancing Optimism with Caution

The Bitcoin Fear and Greed Index, a measure of investor sentiment, reflects this current state of cautious optimism. The index rose to 75 on Monday, inching closer to the “Extreme Greed” zone. While this historically suggests a potential pullback in the price, a sustained upward trend towards 80, fueled by a rebound in total net inflows, could propel Bitcoin back towards its March 14th all-time high of $73,808.

Technical Analysis: Key Levels to Watch

From a technical standpoint, Bitcoin continues to hold above its key 50-day and 200-day exponential moving averages (EMAs), underlining the underlying bullish trend. A decisive break above the $69,000 resistance level would pave the way for a return to the March 14th ATH. The 14-Daily RSI reading of 54.31 also suggests there’s room for further upside before reaching overbought territory.

Conversely, a fall below the crucial $65,000 support level could empower the bears and trigger a test of the $64,000 support zone. A breach of this level could then bring the $60,365 support level into play.

Looking Ahead: Spot ETF Market and Bitcoin’s Trajectory

The coming days will be crucial for the Spot ETF market and Bitcoin. Investor attention will be focused on Monday’s Spot ETF market flow data, particularly the inflows and outflows for GBTC, IBIT, and FBTC. Additionally, any SEC-related news could significantly impact market sentiment.

While the recent outflows raise concerns, it’s important to consider the broader context. The Spot ETF market remains relatively young, and a significant portion of potential investors haven’t yet gained access to these products. A sustained rebound in inflows, coupled with positive developments from the SEC, could reignite the rally and propel Bitcoin towards new highs.

However, if the outflows persist and technical indicators turn bearish, Bitcoin could face a correction. Monitoring the Spot ETF market flow data and the Fear and Greed Index will be essential for gauging investor sentiment and predicting Bitcoin’s future trajectory.