Contents

Oil prices edged up in Asian trading on Tuesday, reflecting the interplay between tightening supply and evolving geopolitical events. While production cuts announced by Russia buoyed prices, the UN-brokered ceasefire between Israel and Hamas introduced a degree of stability in the Middle East, a region crucial for oil production and transportation. This dynamic highlights the delicate balancing act that shapes the oil price forecast, with the potential for rapid shifts based on international developments and OPEC+ policy decisions.

Cautious Optimism in Oil Market

The modest increase in oil prices during Asian trading underscores cautious optimism in the market. Extended production cuts by Russia point towards tighter supply, a factor typically pushing prices higher. However, the UN’s ceasefire resolution between Israel and Hamas tempers these gains by mitigating potential disruptions in the Middle East. This complex interplay creates a situation where oil prices could experience significant fluctuations based on future developments.

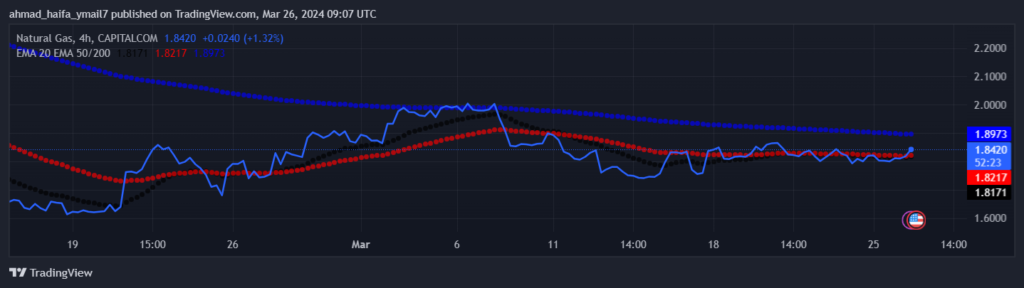

Natural Gas Forecast: Consolidation Phase Above $1.8080

The technical outlook for natural gas (NG) suggests a period of consolidation. The current price of $1.8160 reflects a slight uptick of 0.28%. The market’s pivot point rests at $1.8080, with a breach above this level potentially leading to further gains. Resistance levels are identified at $1.8595, $1.9035, and $1.9408, which could act as ceilings for upward momentum. Conversely, support levels are established at $1.7788, $1.7261, and $1.6795, offering potential brakes on price declines. The 50-day and 200-day Exponential Moving Averages (EMAs) at $1.8207 and $1.8978, respectively, reinforce the consolidation phase, further emphasized by a symmetrical triangle pattern on the chart. While the overall outlook remains bullish above $1.8080, a drop below this threshold could trigger a notable sell-off.

WTI Oil Price Forecast: Bullish Above $81.41

WTI oil (USOIL) dipped slightly by 0.03%, currently trading at $81.97. The technical analysis reveals a pivot point at $81.41, which is critical for understanding the immediate market direction. Resistance levels are charted at $82.93, $83.87, and $84.74, indicating potential hurdles for price increases. On the downside, support exists at $80.32, with further buffers at $79.39 and $78.46, acting as potential floors. The 50-day EMA at $80.98 and the 200-day EMA at $78.86 depict a dominant bullish trend, further bolstered by an upward trendline. The overall sentiment leans bullish as long as prices stay above $81.41; a break below this level could trigger a significant sell-off.

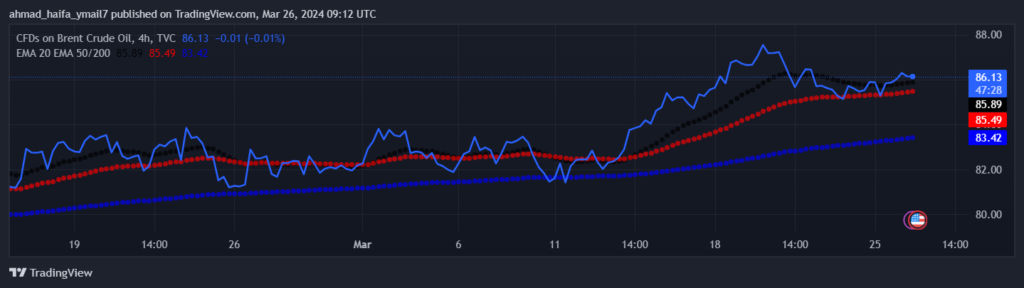

Brent Oil Price Forecast: Bullish Above $85.78

Brent oil (UKOIL) witnessed a minor increase of 0.01%, currently priced at $86.12. The technical analysis pinpoints a pivot point at $85.78, which will likely dictate the market’s near-term trajectory. Resistance levels are charted at $86.46, $87.70, and $88.90, suggesting areas where selling pressure might intensify. Conversely, support levels reside at $84.61, $83.72, and $82.95, offering potential buying opportunities. The 50-day EMA at $85.46 and the 200-day EMA at $83.39 solidify the bullish trend, further strengthened by an upward trendline, particularly if prices stay above $85.78.

Conclusion

The oil price forecast presents a complex picture. While supply constraints due to production cuts and geopolitical tensions offer reasons for bullishness, the recent ceasefire agreement in the Middle East introduces an element of stability. The market’s near-term direction will likely hinge on upcoming developments in the ongoing geopolitical landscape and any policy decisions made by OPEC+.