Contents

US PCE Data Impact on Euro Rates: Eurozone risk sentiment is upbeat, with positive data and fading geopolitical tensions leading to higher yields. However, the direction of the Eurozone is likely to be heavily influenced by the upcoming US PCE data release, highlighting the interconnectedness of global markets.

Highlights:

- Eurozone Upbeat But Uncertain: Positive economic data and easing tensions have improved risk sentiment in the Eurozone, leading to higher yields. However, there’s lingering uncertainty about the future direction of Euro rates.

- US PCE Data Impact: The upcoming release of US PCE data is critical for Eurozone markets. A higher than expected inflation reading in the US could force a reassessment of ECB rate cut expectations.

- ECB vs. Fed Cuts: Markets currently anticipate a more aggressive rate cut path for the ECB compared to the Fed in 2024. However, this hinges on the US inflation data.

- Greek Bond Success Story: The strong demand for Greece’s 30-year bond sale reflects improved market confidence in the Eurozone’s recovery. This is a positive indicator for the region’s overall economic outlook.

Upbeat Risk Sentiment Propels Eurozone Yields

US PCE Data: The Lingering Uncertainty

- Strong PMI data and a slightly better than expected German Ifo survey point towards a cautious recovery in the Eurozone.

- Easing tensions in the Middle East further improve risk appetite.

- Bundesbank President Nagel emphasizes a cautious approach to rate cuts, pushing back against expectations of an automatic series of cuts starting in June.

- Greece’s successful 30-year bond sale reflects improved market confidence, with robust demand exceeding the offering size by a factor of ten.

These positive developments have driven yields higher, with the robust demand for Greek bonds highlighting the improved risk sentiment. The spread between Greek bonds and German Bunds has tightened significantly compared to 2022, reflecting this improved outlook.

US PCE Data Impact: US PCE Data to Determine Euro Rate Direction

Despite the positive signs in the Eurozone, the focus for Euro rates now shifts to the upcoming US PCE data release. Market expectations still see a more aggressive rate cut path for the ECB compared to the Fed in 2024, with expectations of close to three ECB cuts versus just two in the US.

However, this hinges on the US PCE data. An elevated PCE reading could force markets to reconsider the potential for the Fed to hold rates higher for longer, impacting expectations for the ECB. While the ECB emphasizes its independence from the Fed, markets tend to correlate the number of rate cuts between the two central banks.

Thursday’s Key Events and Market Focus

- The release of the advanced US 1Q GDP growth data is not expected to be a major surprise, with a consensus forecast of 2.6%. However, markets will be scrutinizing this data to estimate the core PCE reading for March.

- The current consensus for the core PCE data release on Friday is 0.3% month-on-month, a figure considered too high for comfort and likely to keep market rates elevated. A lower figure would be a positive surprise for markets and could potentially lead to a shift in bearish sentiment.

- Other data points to watch include US initial jobless claims, with a consensus forecast of 215k. However, the focus will likely remain on the earlier GDP release for market direction.

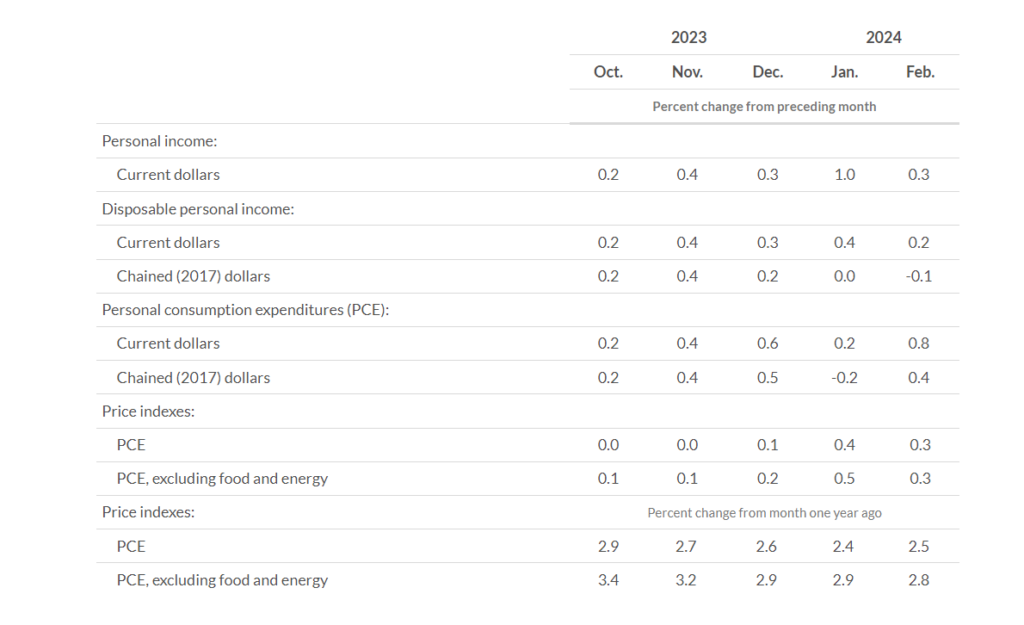

The Bureau of Economic Analysis (BEA) released the Personal Income and Outlays report for February 2024. Here’s a summary of the key findings:

- Personal income increased 0.3% in February, while disposable personal income (DPI) increased 0.2%.

- Personal consumption expenditures (PCE) increased 0.8%.

- The PCE price index increased 0.3%, but remained below the Federal Reserve’s 2% target rate.

Overall, the data suggests that consumer spending is on the rise, but inflation is moderating.

Conclusion

The US PCE Data Impact: A Pivotal Moment for Euro Rates: The upcoming US PCE data release is a critical factor for the Eurozone. A higher than expected reading could force a reassessment of ECB rate cut expectations, potentially leading to a rise in Euro rates. While the ECB maintains its independence, market sentiment often correlates central bank actions, making the US data a key driver for the Eurozone in the near term.