Contents

In Tokyo, Japan, the Nikkei 225 stock market index closed with a gain of 2.33%, reaching a new 1-month high. The market saw notable increases in the Precision Instruments, Electrical/Machinery, and Transport sectors, driving the overall performance.

Top Performers Shine

Among the top performers on the Nikkei 225, Sumitomo Electric Industries Ltd. (TYO:5802) stood out with an impressive 11.41% increase, equivalent to 184.50 points, closing at 1,801.50. Minebea Mitsumi Inc (TYO:6479) followed with a solid 9.82% rise, adding 246.00 points, to conclude the trading day at 2,750.00. Advantest Corp. (TYO:6857) also delivered a strong performance, gaining 8.15% or 322.00 points, reaching 4,271.00 in late trade.

Struggles for Some

Conversely, the session witnessed some underperformers as well. Kawasaki Kisen Kaisha, Ltd. (TYO:9107) faced a substantial decline of 11.38%, losing 611.00 points and closing at 4,760.00. Nissui Corp (TYO:1332) experienced a 7.66% drop, shedding 56.50 points to end at 681.50. Nippon Yusen K.K (TYO:9101) was down by 5.00%, losing 189.00 points, to reach 3,594.00.

Read More: Fed Rate Hike Uncertainty As Global Markets Rebound

Japan Stock Market Market Trends

The Tokyo Stock Exchange reported that rising stocks outnumbered declining ones, with 2810 rising, 868 declining, and 197 ending unchanged. The Nikkei Volatility, measuring the implied volatility of Nikkei 225 options, reached a new 1-month low. Thus, experiencing a major decrease by 4.44% to 20.01.

Economic Progress Present Economic Status and Baseline Scenario for the Future Let’s commence by assessing the current economic landscape. Japan’s economy has undergone a measured revival. The recovery is anticipated to persist, and in the most recent Outlook Report, the Bank has growth rate of 2.0 % for 2023. Subsequently, this growth is predicted to continue at a rate of around 1 percent throughout fiscal years 2024 and 2025, somewhat surpassing its potential growth rate.

Corporate Sector

Looking at the corporate sphere, even though exports of IT-related and other products have struggled due to subdued overseas economic momentum, the overall volume of exports now exceeds pre-pandemic levels. This upturn can be chiefly attributed to heightened exports of automobile-related goods, mirroring a relaxation in supply-side constraints concerning semiconductors. In this context, corporate profits have surged to an all-time high, primarily driven by the normalization of domestic economic activities and the successful transfer of increased costs to consumers. This profit expansion has, in turn, stimulated investments in business infrastructure.

The intentions for corporate investments in fiscal year 2023, as disclosed in the September Tankan, indicate a clear surge 10% compared to fiscal year 2022. Looking forward, the corporate sector is anticipated to maintain its growth trajectory as a virtuous cycle takes shaped. With improved corporate profits driving up business investments.

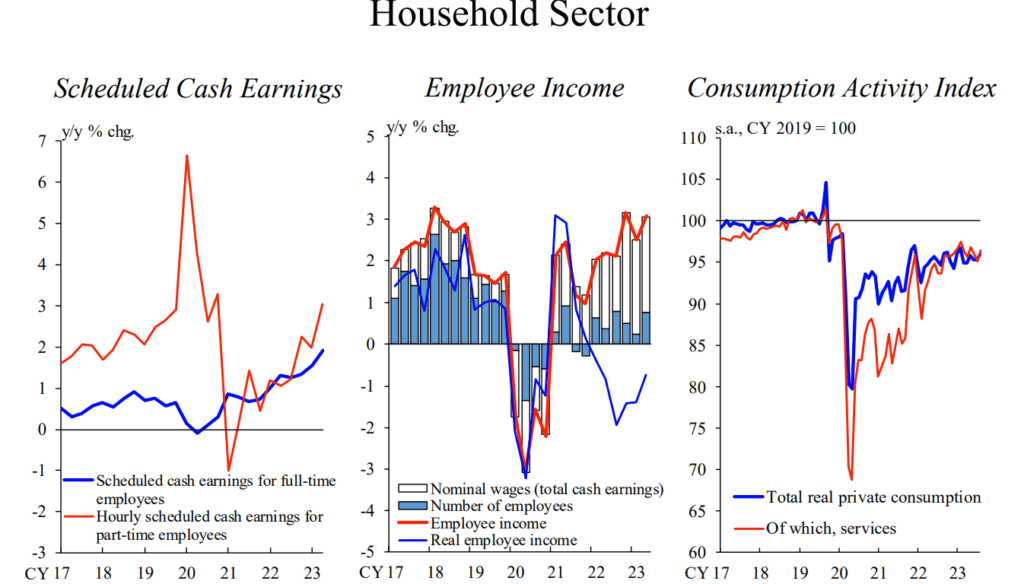

Household Sector

Turning to the household sector, private consumption is on an upward trajectory, primarily driven by the realization of pent-up demand that had been suppressed during the pandemic. It is worth noting that while wage increases have been achieved through the annual spring labor-management wage negotiations. The pace of private consumption growth has been relatively moderate, with ongoing price increments. Regarding future prospects, pent-up demand is projected to taper off gradually. However, it is expected that wages will continue to rise substantially, influenced by elevated prices.

Commodity and Currency

Crude oil for December delivery increased by 0.58%, equivalent to 0.47, reaching $80.98 a barrel. Meanwhile, Brent oil for delivery in January saw a 0.47% increase, adding 0.40 to reach $85.29 per barrel. However, the December Gold Futures contract fell by 0.40%, losing 7.95 to trade at $1,991.25 a troy ounce.

In currency markets, USD/JPY increased by 0.13% to 149.57, and EUR/JPY rose by 0.27% to 160.59. The US Dollar Index Futures remained unchanged at 104.86.

What Drove the Gains?

The Nikkei 225’s 2.33% rise marks a positive turn in the market, with notable gains in key sectors. While some companies excelled, others faced challenges in today’s trading session. The market’s performance reflects a dynamic and ever-changing landscape, with various factors influencing the day’s outcomes.

Investors appear to have been encouraged by the strong performance of Sumitomo Electric Industries, Minebea Mitsumi, and Advantest Corp, signifying a growing interest in electrical machinery, precision instruments, and technology sectors. The technology-driven future appears promising.

Conversely, Kawasaki Kisen Kaisha, Nissui Corp, and Nippon Yusen K.K grappled with notable declines, indicative of potential struggles in the transportation and seafood sectors.

The reduction in the Nikkei Volatility index suggests a decrease in market uncertainties, possibly instilling confidence in investors.

Present Price Status and Future Outlook: Elevated Revisions Linked to the Initial Factor

Let’s delve into the price dynamics in Japan. According to the most recent Outlook Report, the Bank anticipates that the year-on-year growth rate of the Consumer Price Index (CPI), encompassing all categories except fresh food, will remain notably high, standing at 2.8 percent for fiscal years 2023 and 2024, before declining to 1.7 percent in fiscal year 2025. These projected increments in the CPI for fiscal years 2023 and 2024 exceed the figures previously indicated in the July Outlook Report.

Two primary forces underpin the persistence of relatively high inflation rates. The first force stems from inflationary pressures arising due to the transmission of heightened import prices to consumer prices. The surge in import prices, particularly in energy and grains, has gradually influenced consumer prices, albeit with some time lag. The second force is driven by inflationary pressures resulting from the mechanism through which wages and prices mutually reinforce each other, boosted by the continuous economic upswing.

The leading reason for the upward revision of the CPI forecasts by the Bank in its most recent Outlook Report for the period up to fiscal 2024 lies in the belief that the first force. However, these two, will endure. Particularly concerning food and everyday necessities, while the extent to which the past elevation in import prices is transferred to selling prices has tapered off for some items. And sectors, certain businesses have opted to raise their selling prices afresh in response to price escalations.

Looking Ahead

The resilience of the Japanese stock market in the face of various global economic dynamics will likely continue to be a subject of keen interest. As market trends evolve, investors will remain vigilant, adapting to emerging opportunities and challenges.

The impact of commodity price fluctuations and currency exchange rates on the Japanese market is an aspect to monitor closely, as these factors can have a profound influence on the stock market’s performance.

In conclusion, the Nikkei 225’s notable rise reflects the dynamic nature of the Japanese stock market, presenting both opportunities and challenges for investors. The performance of top and bottom performers in this session serves as an insightful glimpse into the complex world of stock trading.

Do you need help in finding the best crypto exchange for your needs?

Click here: The Best Crypto Exchange Finder

Disclaimer: Please note that this article serves solely for informational purposes and shall not comprise of financial advice. We advise readers to conduct with research and consult with financial professionals before making any investment decisions

Follow Us on Facebook: Tradingcompass.io