Contents

Interactive Brokers (NASDAQ:IBKR), a leading player in the electronic trading space, has made a significant move by launching Hong Kong ETPs (Spot Bitcoin and Ether Exchange Traded Products). These ETPs are now available for trading on the Hong Kong Stock Exchange, offering a convenient and accessible way for investors to gain exposure to these popular cryptocurrencies.

This launch represents a major expansion of product offerings for eligible clients of Interactive Brokers Hong Kong. They can now seamlessly trade these Hong Kong ETPs alongside a vast array of traditional assets on a single, unified platform. This includes stocks, options, futures, currencies, bonds, and various funds, providing unparalleled flexibility and diversification potential within a single brokerage account.

Simplified Cryptocurrency Exposure through Hong Kong ETPs

One of the key advantages of these Hong Kong ETPs is their ability to simplify cryptocurrency investment. Investors can gain exposure to Bitcoin and Ether without the complexities associated with directly owning the digital assets themselves. This eliminates the need for personal crypto wallets, mitigating the risks of technical complexities and potential security vulnerabilities.

Through their existing IBKR brokerage accounts, clients can effortlessly purchase these Hong Kong ETPs, adding a layer of cryptocurrency exposure to their existing portfolios. This streamlined process removes the technical hurdles often associated with directly investing in cryptocurrencies, making it more accessible to a broader range of investors.

Enhanced Flexibility and Streamlined Management

The introduction of Hong Kong ETPs by Interactive Brokers provides investors with greater flexibility in managing their cryptocurrency holdings. Clients can now leverage their existing brokerage accounts to manage both traditional and crypto assets within a single, familiar platform. This eliminates the need to switch between separate platforms for different asset classes, streamlining the investment management process.

David Friedland, Head of APAC for Interactive Brokers, emphasizes the significance of this launch: “We are thrilled to introduce these new Hong Kong ETPs, expanding our product offerings. These straightforward instruments provide our clients with enhanced flexibility to manage cryptocurrency exposure within their existing brokerage accounts, alongside the broad range of global products available through Interactive Brokers.”

Available Hong Kong ETPs and Future Developments

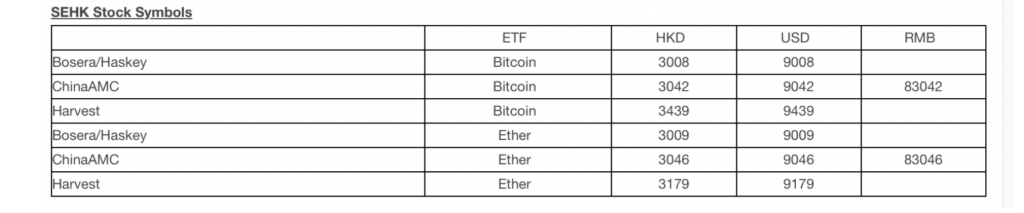

As of April 30, 2024, investors can access the following Hong Kong ETPs: