Contents

Australian home prices soared to unprecedented levels, defying a significant surge in interest rates, according to recent data from property consultancy CoreLogic. This revelation, unveiled on Thursday, indicates a potential lack of restriction within monetary policy.

Australian Home Prices Recovery Amidst Fluctuations

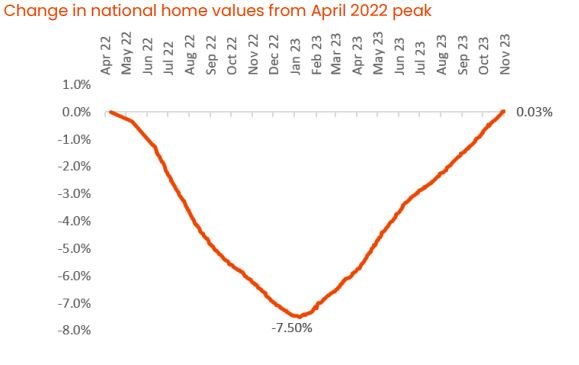

Since hitting a low point on January 29 this year, the national HVI has risen by an impressive 8.1%. Tim Lawless, CoreLogic’s Executive Research Director, noted that it took around nine months for the HVI to move from record highs to the recent trough. However, the subsequent recovery from this brief downturn spanned roughly ten months.

Australian property prices have soared, surpassing the previous peak observed in April 2022, according to the latest data from CoreLogic’s national Home Value Index (HVI). On November 22, the HVI exceeded the national median dwelling price record of $768,777, indicating a substantial surge in the real estate market.

Resilience Amidst Interest Rate Shifts

Despite a substantial uptick in interest rates, home prices have escalated by 8.1% since January, as of November 22. This surge effectively outweighs the preceding 7.5% decline initiated after the Reserve Bank of Australia commenced tightening monetary policy in May of the previous year, as per CoreLogic’s findings.

Read More: RBA Interest Rate Jumps As Global Inflation Slows Down

It took approximately nine months for prices to transition from record highs to the recent low point, followed by a swift recovery period spanning around 10 months.

Among the capital cities, Perth, Adelaide, and Brisbane have all marked record-high prices. However, Sydney and Melbourne still lag behind, standing 1.8% and 3.6% lower, respectively, compared to their previous peaks in March of the preceding year.

Australian Home Prices Impact on Monetary Policy

The property market’s steadfastness serves as one of the driving forces behind the Reserve Bank of Australia’s decision to resume raising interest rates. This recent move elevated rates to a 12-year high of 4.35% this month, following four months of stable outcomes.

Since hitting a low point on January 29 this year, the national HVI has risen by an impressive 8.1%. Tim Lawless, CoreLogic’s Executive Research Director, noted that it took around nine months for the HVI to move from record highs to the recent trough. However, the subsequent recovery from this brief downturn spanned roughly ten months.

Understanding the Market Dynamics

Despite high-interest rates, pessimistic consumer sentiment, and escalating living costs, Lawless explained the surprising V-shaped recovery. The imbalance between supply and demand plays a pivotal role. Advertised economic levels remained remarkably low throughout 2023, contributing to the market’s upward momentum.

Cities like Perth, p, hitting record highs alongside their regional counterparts within their respective states. However, Hobart’s values remain 11.8% below their peak, while Regional Victoria’s dwelling values are 7.0% lower than their record highs.

Challenges and Opportunities

The limited property price growth in cities like Sydney and Melbourne is attributed to affordability issues and regulatory constraints. However, other regions offer better value for investment, attracting attention due to lower median dwelling values.

Read More: Are U.S. Stocks Headed for a Pause After a Breathtaking Surge?

Investors are exploring alternative markets due to regulatory uncertainties, while prospective buyers face affordability challenges amid rising living costs. Despite these hurdles, there’s a resurgence in local demand driven by migration.

Australian Home Prices Expectations and Market Speculations

Developers and builders are actively engaging the market by offering incentives and rebates, aiming to address the volume of available stock and cater to the growing demand for properties in Melbourne’s corridors and regional centers.

The evolving landscape of the Australian property market underscores the complexities between affordability, market dynamics, and regulatory environments, influencing both investors and potential homeowners alike.

The RBA anticipates that the additional wealth generated from the resurgence of property prices will bolster consumer spending. Market speculations, however, suggest a mere 5% probability of another rate hike in December. Nevertheless, there’s an implication of approximately a 40% likelihood of another rate adjustment in the upcoming year.

This resilience in the Australian property market amidst interest rate fluctuations highlights a complex interplay between monetary policy and market dynamics, with implications for both homeowners and potential buyers.