Contents

- 1 Exploring the Dynamics of NVIDIA

- 2 Nvidia Financial Performance and Investor Confidence: Driving Growth and Innovation

- 3 How to buy Nvidia stock?

- 4 Selling NVIDIA Shares: Navigating the Process

- 5 Conclusion: Seizing the Future with NVIDIA Stock

Embarking on the journey of stock investment entails careful consideration and strategic decision-making. In the realm of technology, NVIDIA Corporation, or Nvidia, emerges as a prominent player, offering investors a gateway to the dynamic world of graphics processing and artificial intelligence.

Exploring the Dynamics of NVIDIA

NVIDIA Corporation, often referred to simply as Nvidia, stands as a global technology powerhouse. Founded in 1993 in Santa Clara, California, Nvidia has cemented its position as a leader in graphics processing and artificial intelligence.

Origins and Vision: Pioneering the Future of Computing

Founded by three visionaries in the early 1990s, Nvidia emerged from the foresight that computing’s future lay in graphics. They anticipated the burgeoning demand for computational power, especially in the gaming industry, which propelled Nvidia into existence with a modest capital of US Dollar 40,000.

Innovations Across Industries: Leading the Way in Graphics and AI

Today, Nvidia’s reach extends far beyond mere graphics. With a primary focus on personal computer graphics, GPUs, and artificial intelligence, Nvidia serves a diverse clientele across PC, mobile, and cloud architectures. Their product line, including the renowned “GeForce” series, dominates the gaming industry, boasting innovations like the Shield Portable, Shield Tablet, and Shield Android TV.

Strategic Focus and Market Domination: Nvidia from Gaming to Automotive

Nvidia’s strategic focus spans across gaming, professional visualization, data centers, and automotive sectors. As artificial intelligence gains prominence, Nvidia is at the forefront, providing parallel processing capabilities to researchers and scientists, as well as producing Tegra mobile processors for smartphones and tablets.

Upholding Values and Ethical Standards: Fostering a Culture of Excellence

Nvidia attributes its success to its workforce and values. Upholding principles of innovation, agility, excellence, and integrity, Nvidia fosters a culture of collaboration and excellence. It prioritizes customer satisfaction and operates with utmost integrity, ensuring its performance remains grounded in ethical standards.

Nvidia Financial Performance and Investor Confidence: Driving Growth and Innovation

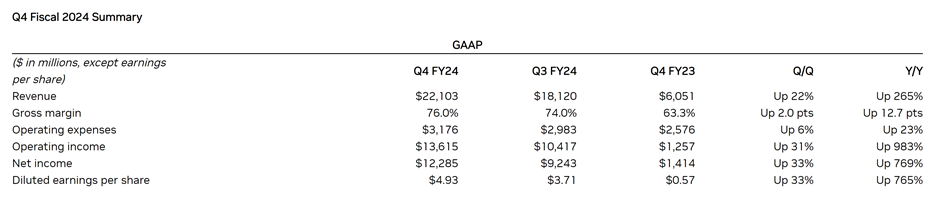

NVIDIA has unveiled remarkable financial results for the fourth quarter and fiscal year 2024, demonstrating record-breaking achievements that underscore its strong growth trajectory.

In the fourth quarter ending January 28, 2024, NVIDIA reported unprecedented quarterly revenue of $22.1 billion, representing a substantial 22% increase from the previous quarter and an impressive 265% surge from the corresponding period a year ago. The company also experienced exceptional growth in Data Center revenue, reaching $18.4 billion, up by an impressive 27% from the third quarter and a remarkable 409% from the same period last year.

During the quarter, GAAP earnings per diluted share surged to $4.93, marking a notable 33% rise from the previous quarter and an outstanding 765% surge from a year ago. Meanwhile, non-GAAP earnings per diluted share reached $5.16, reflecting a commendable 28% increase from the previous quarter and an impressive 486% rise from a year ago.

For fiscal 2024, NVIDIA reported record-breaking revenue of $60.9 billion, showcasing an extraordinary 126% growth trajectory. GAAP earnings per diluted share for the fiscal year amounted to $11.93, representing a remarkable 586% surge from the previous year. Additionally, non-GAAP earnings per diluted share reached $12.96, marking an impressive 288% increase from the previous year.

Jensen Huang, founder and CEO of NVIDIA, attributed the stellar performance to accelerated computing and generative AI, which have experienced a surge in demand across various companies, industries, and nations.

“Our Data Center platform continues to thrive, driven by diverse demand drivers including data processing, training, and inference from large cloud-service providers, GPU-specialized entities, enterprise software, and consumer internet companies,” stated Huang. “Vertical industries such as automotive, financial services, and healthcare have now emerged as multibillion-dollar markets.”

Huang also highlighted the monumental success of NVIDIA RTX, which has evolved into a massive PC platform for generative AI, serving over 100 million gamers and creators worldwide. Looking ahead, Huang teased major new product cycles with groundbreaking innovations set to propel the industry forward.

NVIDIA is scheduled to pay its next quarterly cash dividend of $0.04 per share on March 27, 2024, to all shareholders of record on March 6, 2024.

Read more: The Meteoric Rise of Nvidia Stock: Unraveling the Phenomenon

How to buy Nvidia stock?

So, you’ve set your sights on a company for investment. Now, it’s time to navigate the intricate process of acquiring shares effectively.

1) Opening Your Account

Before diving into the market, you need a brokerage account. Whether you’re a seasoned trader or a novice investor, selecting a regulated brokerage is paramount. The realm of stockbroking offers a myriad of options, from traditional platforms to sleek mobile apps.

As you embark on this journey, keep these factors in mind:

- Stay aligned with your financial objectives.

- Brace yourself for the market’s inevitable fluctuations.

- Keep trading costs to a minimum to optimize returns.

- Understand the potential tax implications of your investments, especially regarding capital gains.

Before you make your move, ask yourself:

- Should I seek guidance from a financial advisor?

- Am I comfortable with the level of risk associated with this investment?

- What is my investment budget?

- Can I afford potential losses?

- Do I possess a clear understanding of the company’s operations and market positioning?

2) Identifying Your Trading Platform

The company you’re eyeing, NVIDIA, is traded under the ticker symbol NVDA on the Nasdaq exchange. Nasdaq’s trading hours, from 9:30 am to 4 pm Eastern Time, dictate the window for executing trades.

Most brokerage platforms facilitate the purchase of US shares, albeit subject to foreign exchange fees and currency risks.

Best brokers to trade NVIDIA stocks:

Interactive Brokers:

- Interactive Brokers stands as a top-tier broker catering to forex, stocks, ETFs, cryptocurrency, bonds, options, futures, and more.

- Clients enjoy access to over 100 tradable currency pairs, benefiting from tight spreads as narrow as 1/10 PIP.

- Real-time quotes are available from 17 of the world’s largest FX dealers, ensuring up-to-date market information.

- Low commissions are offered with no hidden spreads or markups, providing transparency and cost-effectiveness.

Additional details include:

- Minimum deposit requirement: $100

- Trustpilot score: 3.7 stars

- Currency pairs available: 100+

- Trading platforms offered: TraderWorkstation (TWS), with Introducing Brokers available through oneZero Hub Gateway for MetaTrader 5 compatibility.

- Maximum leverage: 30:1 for major currency pairs and 20:1 for minor currency pairs

Plus500:

- Plus500, a derivatives broker headquartered in Europe, specializes in offering forex trading and more to various traders, particularly advanced ones or those who prefer mobile trading.

- The platform provides comprehensive information on the assets available for investment, enabling users to enter the foreign currency market and add currency pairs to their portfolios.

- While demo accounts are available for new users to practice, the platform lacks sufficient educational tools, making it less ideal for beginners. As a result, novice traders may consider exploring other options, while experienced traders utilize Plus500 to capitalize on these unique assets.

- Minimum deposit requirement: $100

- Trustpilot score: 4 stars

- Currency pairs offered: 60+

- Trading platform: Web Platform

- Maximum leverage: 1:300

Forex.com:

- As a subsidiary of StoneX (NASDAQ: SNEX), FOREX.com stands out as the top forex broker in the market.

- Catering to forex traders, FOREX.com offers a diverse range of tradable currencies, low account minimums, and a notable trading platform, making it an ideal choice for brokers.

- FOREX.com provides a comprehensive education and research center featuring free forex trading courses tailored to various skill levels, benefiting both novice and seasoned traders.

- Regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the U.S., FOREX.com ensures a secure trading environment for U.S. clients, with oversight from regulators in six major jurisdictions through its subsidiaries.

- Key features:

- Minimum deposit: $100

- Trustpilot score: 4 stars

- Currency pairs: 80+

- Trading platforms: MT4, MT5, Advanced Trading (desktop), Web Trading platforms, TradingView, and NinjaTrader

- Maximum leverage: Up to 50:1

3) Conducting Thorough Research

Knowledge is power in the world of investing. Delve into NVIDIA’s investor relations page to glean insights into its financial performance, strategic initiatives, and future prospects.

Furthermore, compare NVIDIA’s valuation metrics with those of its industry peers to gauge its relative attractiveness as an investment opportunity. Price-earnings ratios and brokers’ 12-month price forecasts serve as valuable tools in this endeavor.

4) Crafting Your Investment Strategy

The manner in which you approach investing can significantly impact your returns. Decide whether you prefer a lump-sum investment or a phased approach.

Pound-cost averaging, a strategy that involves investing fixed amounts at regular intervals, can help mitigate the impact of market volatility and minimize the risk of investing a large sum at an inopportune time. Conversely, lump-sum investing offers immediate exposure to the market.

5) Executing Your Order

When you’re ready to make your move, log into your brokerage account, locate NVIDIA’s ticker symbol, and specify the number of shares you wish to purchase. Consider implementing stop-loss orders to limit potential losses in case of adverse price movements.

6) Monitoring and Managing Your Portfolio

Successful investing requires ongoing vigilance. Regularly review your portfolio’s performance and make adjustments as needed. Whether it’s on a monthly, quarterly, or annual basis, stay attuned to market dynamics and emerging trends.

Should the need arise to liquidate your holdings, familiarize yourself with the process of selling shares. Log into your brokerage account, locate NVIDIA’s ticker symbol, and initiate the sell order. Be mindful of potential tax implications, particularly regarding capital gains taxes.

Investing via Funds: Exploring Alternative Avenues

For those seeking a diversified approach to investing, consider exploring funds that hold NVIDIA shares. By investing in a diversified portfolio of assets, you can mitigate the risks associated with individual stock investments while capitalizing on broader market trends.

Conclusion: Seizing the Future with NVIDIA Stock

Investing in NVIDIA stock isn’t just about financial gain—it’s about embracing innovation and shaping the future of technology. As NVIDIA continues to push boundaries in graphics processing and artificial intelligence, investors join a journey of transformation and growth.

With a rich history of innovation and steadfast values, NVIDIA remains at the forefront of technological advancement. By understanding the investment process and staying attuned to market dynamics, investors can navigate with confidence and precision.

NVIDIA stock represents more than an investment opportunity; it symbolizes a pathway to a future defined by innovation and limitless possibilities. As investors align with NVIDIA’s vision, they become part of a community driving change and shaping the world of tomorrow.