Contents

In the volatile landscape of cryptocurrency, Bitcoin 2023 journey took a turbulent turn in 2023 as it encountered a sharp 7.5% drop, aiming straight for the $40,000 mark. This sudden plunge rattled Bitcoin and triggered a broader selloff across the crypto market. The reasons behind this abrupt downturn and its impact on the crypto sphere come into focus, shedding light on the intricacies of this ever-fluctuating digital asset realm.

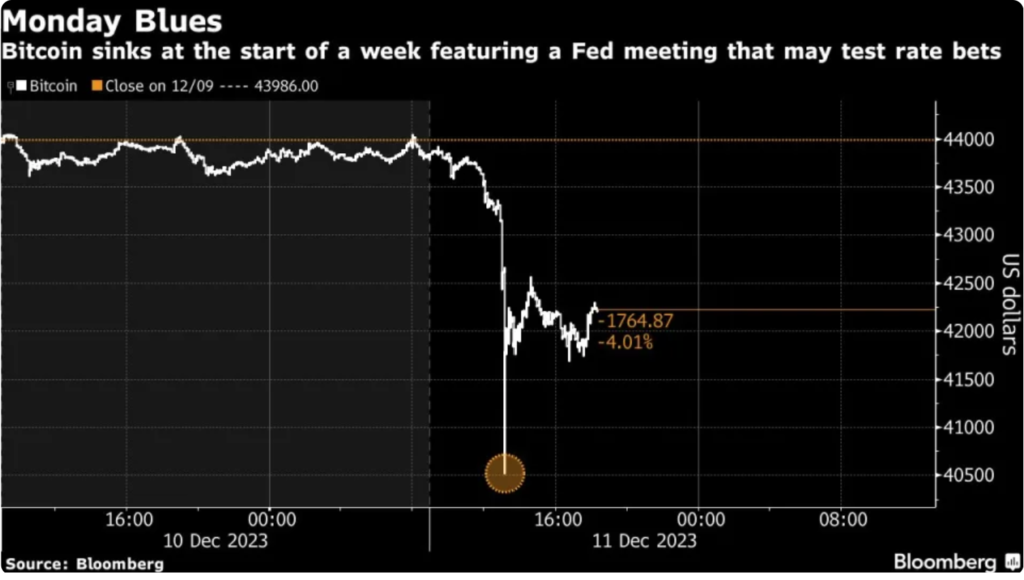

In a swift move, the largest token nosedived to $40,521 before recovering slightly, settling at a 3.6% decrease, valuing at $42,245 at 7:15 a.m. on Monday in London. Smaller tokens like Ether, XRP, Polkadot, and Cardano also experienced a downturn. The top 100 digital assets recorded a significant 4% decline, marking the steepest drop since Nov. 22.

Key Highlights

- Bitcoin 2023 experienced a rapid 7.5% drop towards $40,000, triggering a broader crypto market selloff.

- Other major tokens like Ether, XRP, Polkadot, and Cardano also saw declines.

- Market volatility is attributed to rising leverage rather than specific news catalysts.

- Approximately $312 million in crypto trading positions were liquidated on Dec. 11.

- Investors brace for US inflation data and the Federal Reserve’s final 2023 policy meeting, influencing cautious sentiment and market fluctuations.

Rationale Behind Bitcoin 2023 Roller-Coaster Ride

The year has seen Bitcoin on an upward trajectory, driven by optimism surrounding the potential approval of the first US exchange-traded funds investing directly in the token. Additionally, speculations about the Federal Reserve’s plan to reduce interest rates by 2024 have fueled the rally in Bitcoin and the overall cryptocurrency realm.

Richard Galvin, co-founder at Digital Asset Capital Management in Sydney, attributed the recent fall to escalating market leverage rather than a fundamental news catalyst. Coinglass data revealed the liquidation of approximately $312 million worth of crypto trading positions betting on higher prices on Dec. 11, marking the highest tally since mid-September.

Read More: Bitcoin Price and Ether Witnesses Extreme Volume Surge

Anticipating Market Moves

Investors are preparing for critical US inflation data and the final 2023 policy meeting of the Federal Reserve, both anticipated to challenge aggressive predictions of rate cuts. This uncertainty has translated into wavering global stocks and US equity futures and a slight uptick in a dollar gauge, signifying cautious sentiment.

Tony Sycamore, a market analyst at IG Australia Pty, suggested that profit-taking amid such uncertainty is a logical move. He foresees a decline toward the $37,500 to $40,000 range, expecting substantial support from dip buyers during these dips.

Read More: Dogecoin 10th Anniversary: Remarkable Hit Of $0.1063

Bitcoin 2023 Performance and Beyond

Despite the recent turmoil, Bitcoin has soared more than 150% year-to-date, contributing to the broader recovery of digital asset prices following the $1.5 trillion market rout in 2022. Nevertheless, the token remains considerably below its pandemic-era peak of nearly $69,000 set just over two years ago.

Bitcoin’s recent stumble toward $40,000 and the subsequent crypto market downturn highlight the ongoing volatility and uncertainty surrounding digital assets, influenced by various market factors and upcoming economic indicators.

Conclusion

In conclusion, Bitcoin’s recent 7.5% drop toward $40,000 sent shockwaves across the crypto market, highlighting the asset’s volatility. Factors such as market leverage, anticipation of regulatory decisions, and economic indicators loom large, shaping Bitcoin’s trajectory amid an uncertain landscape for digital assets.