Contents

Uniswap (UNI) price currently exchanges hands at $4.09 and might be in for a correction soon as Uniswap Foundation sends 500,000 worth of UNI to OKX exchange. In total, these tokens are worth roughly $2 million at the current rate and are likely to be sold soon.

Uniswap (UNI) price has been trading around the $4.02 support level for the last six weeks. The recent deviation below this level in mid-October was followed by a 16% rally in six days. As this quick upswing formed a local top at $4.50, things started going downhill for UNI, which knocked it down by 9.24%.

As UNI trades around $4.09, it risks a further drop, especially considering the Relative Strength Index (RSI), which seems to be getting rejected by the 50 mean level. A breakdown of the $4.02 support level could trigger an 8% correction to $3.70. A further spike in selling pressure caused by relentless selling could send UNI in a tailspin down to revisit the $3.35 support. This move would constitute a 17% crash for Uniswap price and UNI holders.

Also Read: Uniswap Founder Burns $650 Billion HayCoin in Effort to Curb Speculation

Uniswap price Foundation’s UNI Transfers and Bearish Market Signals

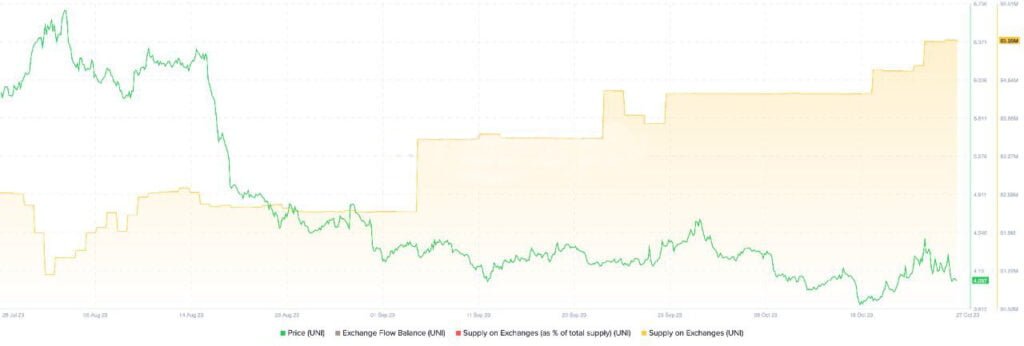

While Uniswap Foundation sending UNI to exchanges is potentially bearish, the technicals add credence to this outlook. On-chain metrics also paint a bearish picture of Uniswap price. The supply of UNI held on exchanges has noted a spike from 62.27 million UNI to 65.35 million UNI. That was between September 4 and October 27. This 4.94% uptick suggests that more investors are unsure about UNI’s future. Furthermore they are holding their tokens on exchanges to sell should the scenario present itself.

Uniswap Whales Decrease Holdings Amid Bearish Sentiment

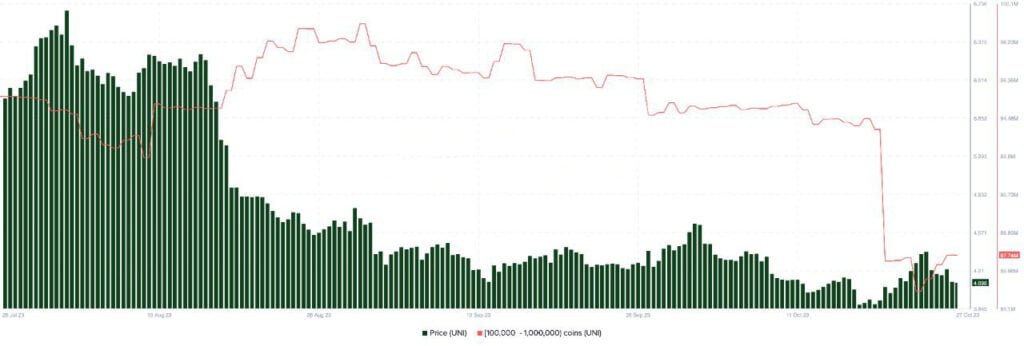

While the supply on exchanges continues to rise, Uniswap whales are offloading their holdings, which further helps the bearish stance. Wallets holding 100,000 to 1,000,000 UNI have reduced from 93.91 to 87.74 in under ten days. The 6.57% drop in the balance of whale wallets indicates but one thing – investors’ lack of confidence in bulls and the performance of Uniswap price.

While the prevailing outlook for the Uniswap price leans predominantly bearish, it is noteworthy that a sudden upsurge in buying pressure, resulting in a daily candlestick closure above $4.38, would constitute a higher high. Such a development would invalidate the bearish outlook and potentially catalyze a rapid 15% upswing, targeting a price level of $5.04.

Do you need help in finding the best crypto exchange for your needs?

Click here: The Best Crypto Exchange Finder

Disclaimer:

Please note that this article serves solely for informational purposes. As such, it is not financial advice. We strongly advise readers to conduct thorough research and consult with financial professionals before making any investment decisions.