Contents

In the dynamic world of investment, diversification is often considered a key strategy to manage risk and optimize returns, While gold has long been a stalwart in many investors’ portfolios, 2024 presents opportunities to explore alternative metals that may offer attractive prospects, This article delves into Metals 2024 Forecast, offering a fresh perspective on diversifying portfolios

Highlights:

- In 2024, silver (XAG/USD) eyes $30.00 with declining mine production and rising industrial demand.

- Predicted rebound for copper above $4 per pound in 2024; consider investments in Copper ETF (CPER) and Freeport McMoRan (FCX).

- 2024 sees a platinum deficit amid strong global demand, production issues, and prices between $800/oz and $1,100/oz.

- Despite a 2024 deficit, palladium faces challenges from reduced recycling, increased primary supply, and lower demand from platinum substitution and Battery Electric Vehicles (BEVs).

Metals 2024 Forecast:

Silver: The White Metal with Potential Shine

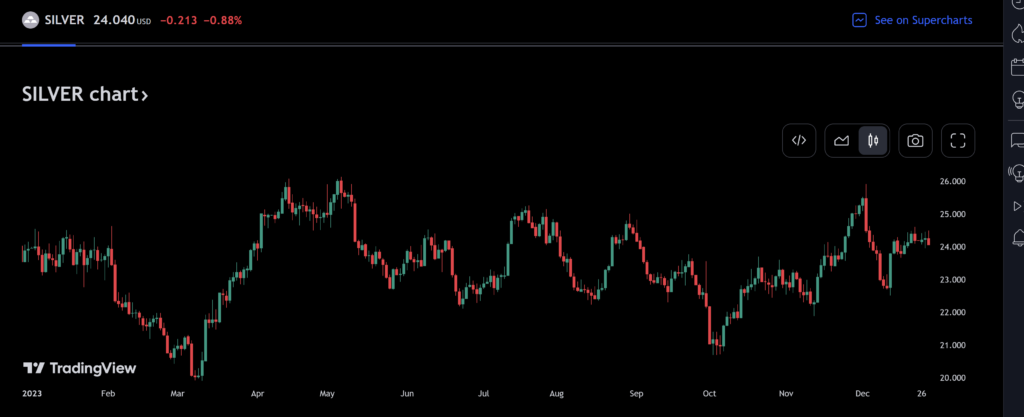

In the context of the Metals 2024 Forecast, silver is poised for potential upside momentum. It spent 2023 within a $20-$26 range, facing resistance at $26.00. The gold/silver ratio fluctuated, impacting silver’s performance. Despite geopolitical uncertainties, silver’s role as a safe-haven asset may be tempered.

Silver mine production has declined since 2016, while demand, especially in the industrial sector, is expected to rise. The global economic outlook, potential rate cuts by central banks, and technical analysis suggest that silver may experience solid demand and could reach $30.00 if it surpasses the $26.00 level.

Read more: Silver Prices Forecast: Unveiling the Big Impact of CPI and Fed Reserve Moves

Copper: The Industrial Backbone

In 2024, copper is anticipated to see a potential rebound in prices above $4 per pound after trading around $3.70 in mid-November 2023. Factors influencing this outlook include a shift in the Fed’s monetary policy to a more dovish stance and the importance of China’s economic performance.

Despite a recent decline, copper prices continue to reflect global demand and limited supplies. Investments in the Copper ETF (CPER) or copper futures are suggested, while Freeport McMoRan (FCX), a leading copper producer, is identified as a potential beneficiary of higher copper prices. Overall, there is optimism for increased copper prices in 2024, but caution is advised in long risk positions due to the volatile nature of the commodity market.

Platinum: Beyond Precious, into Industrial Terrain

The 2024 outlook for platinum suggests a deficit of 445 koz, driven by robust global demand reaching 7.5 moz and a slight dip in the global supply to 5.6 moz. Challenges persist in South African production due to falling PGM prices, potential mine closures, and reduced output. Secondary platinum supply from autocatalyst recycling is expected to remain weak due to high new vehicle prices and semiconductor shortages.

Demand for platinum in autocatalysts is stable at 3.5 moz, with a 1% year-on-year growth. Industrial demand is projected to remain consistent at 2.3 moz, offsetting challenges in the glass sector. Platinum prices in 2024 are forecasted to trade between $800/oz and $1,100/oz, influenced by a market deficit, macroeconomic weaknesses, and potential mine closures. The rand’s depreciation offers limited price support.

Palladium: Riding the Wave of Automotive Innovation

In 2024, the Palladium market is expected to face a significant deficit due to decreased recycling and increased primary supply in South Africa and North America. Demand is declining from platinum substitution and limited growth in Internal Combustion Engine (ICE) light-vehicle production.

Supply risks include potential production cuts in South Africa and North America, and delays in autocatalyst recycling in China due to the semiconductor chip shortage. Automotive sector demand for Palladium is predicted to drop by 3%, influenced by slowed light-vehicle production and increased Battery Electric Vehicle (BEV) market share. Industrial demand is also expected to decrease, leading to potential price decline to $700/oz-$1,200/oz despite the projected deficit.

Conclusion

As we approach 2024, the landscape of safe-haven investments is shifting beyond the traditional reliance on gold, The evolving global economy presents a diverse range of opportunities, urging investors to consider metals beyond the classic yellow allure, In the Metals 2024 Forecast, it’s evident that silver, copper, platinum, and palladium emerge as compelling options for portfolio diversification, Understanding the distinctive dynamics and applications of each metal in both luxury and industry is crucial for making informed investment decisions, Thorough research, staying abreast of market trends, and seeking advice from financial experts remain essential steps for success in navigating the ever-changing world of metals investment.